Simply because it appears the stack of crypto-asset ETF purposes on the SECs desk couldn’t get any taller, one other inevitably seems. Bitcoin is booming, crypto regulation has grow to be a sizzling subject in Washington, and everybody appears to need a piece of the pie.

Nevertheless, the crypto area is a lot extra than simply foreign money. The blockchain know-how that underpins nearly all of the crypto market might, in accordance with proponents, enhance the effectivity, safety, and connectivity of virtually each piece of significant infrastructure on the earth.

Blockchain ETFs began coming to market through the authentic 2017-2018 Bitcoin growth, in response to the SEC’s rejection of pure-play Bitcoin ETFs.

Nevertheless, within the wake of the COVID-19 pandemic, which uncovered points within the connectivity of many programs, together with provide chain administration and healthcare, blockchain know-how has grow to be beneficial in and of itself.

BLOK Soars Above the Competitors

The Amplify Transformational Data Sharing ETF (BLOK) was the primary Blockchain ETF to market, launching on January sixteenth, 2018, every week or so earlier than the First Trust Indxx Innovative Transaction & Process ETF (LEGR) and the Capital Link NextGen Protocol ETF (KOIN), and simply in the future earlier than the Siren Nasdaq NextGen Economy ETF (BLCN).

As the primary Blockchain ETF to market, BLOK was capable of increase considerably extra belongings than any of its opponents, with almost thrice the quantity of whole belongings below administration than another Blockchain ETF at time of writing.

BLOK invests primarily in firms immediately concerned within the improvement and utilization of blockchain know-how. Regardless of investing in most of the similar firms as its opponents, BLOK stays forward of the pack.

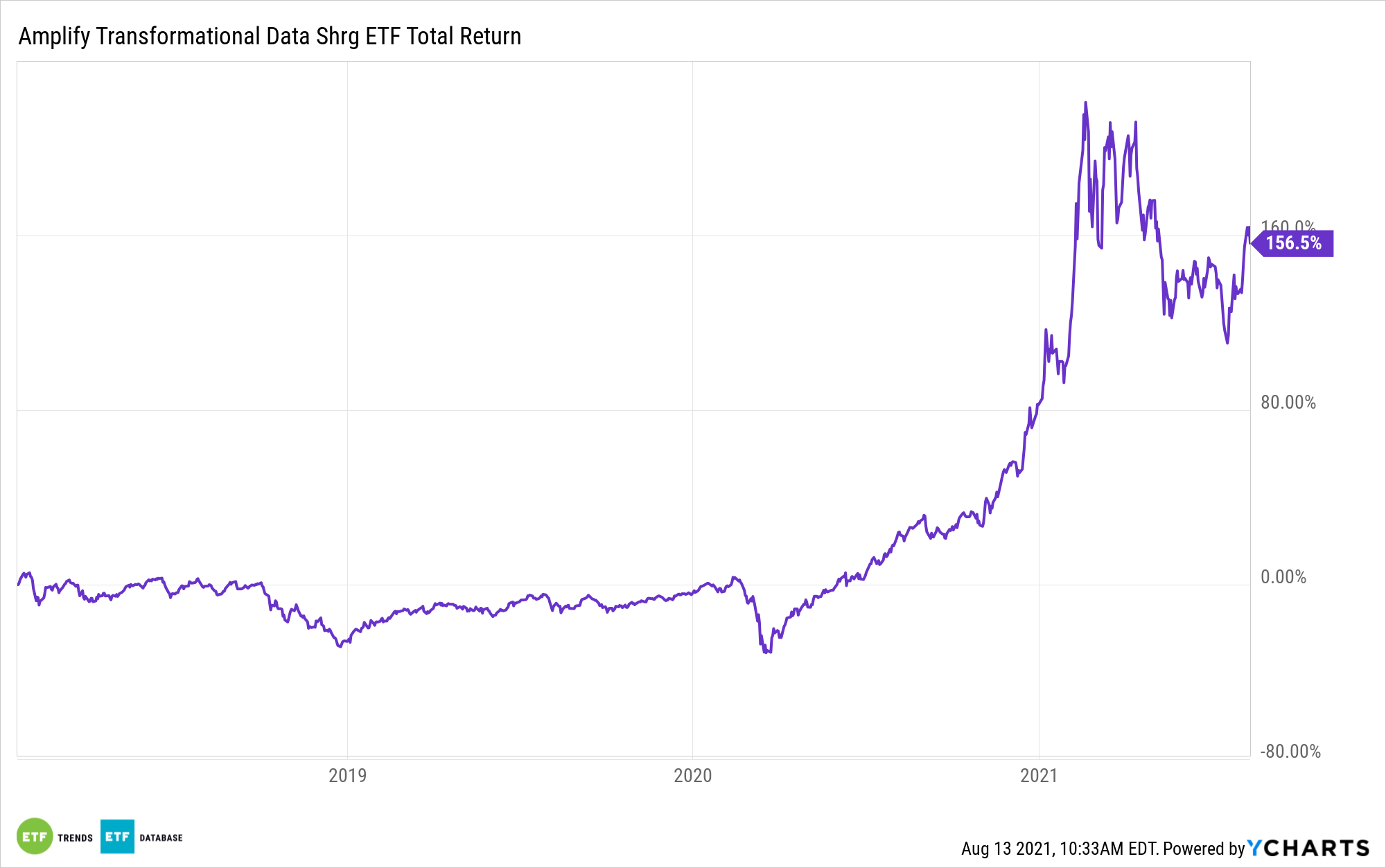

The fund is ranked second out of thirty-six within the etfdb.com Know-how Fairness ETF class for three-year returns, with a three-year return of 161.31%. It ranks first for each one-year and year-to-date returns, with returns of 112.98% and 42.65% respectively.

An actively managed fund, BLOK has unfold its belongings throughout 46 holdings, which embody giant cap, mid cap, and small cap firms, with giant cap firms holding just below half the fund’s whole belongings.

The ETF invests in a number of crypto mining firms and exchanges, in addition to firms akin to Sq. and Paypal, which take care of each conventional currencies in addition to cryptocurrencies.

BLOK has an expense ratio of 0.71%.

For extra information, info, and technique, go to the Crypto Channel.