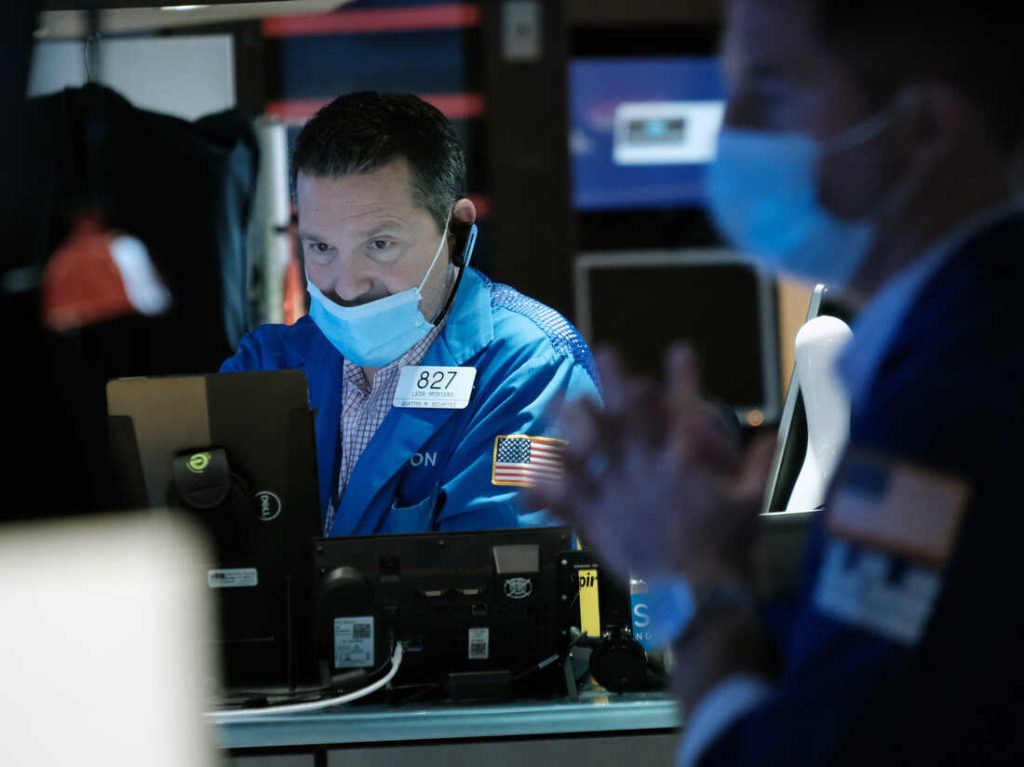

Merchants work on the ground of the New York Inventory Alternate (NYSE) on Jan. 20 in New York Metropolis. Shares continued to stoop on Monday because the Federal Reserve gears as much as elevate rates of interest in a bid to deliver down inflation from 40-year highs.

Spencer Platt/Getty Photos

disguise caption

toggle caption

Spencer Platt/Getty Photos

Merchants work on the ground of the New York Inventory Alternate (NYSE) on Jan. 20 in New York Metropolis. Shares continued to stoop on Monday because the Federal Reserve gears as much as elevate rates of interest in a bid to deliver down inflation from 40-year highs.

Spencer Platt/Getty Photos

It has been a brutal begin to the yr for shares, and it is bringing a three-year rally in markets to an abrupt halt.

The Dow Jones Industrial Common slumped by greater than 700 factors on Monday, or a decline of greater than 2%, and was headed for a seventh consecutive each day fall.

It was even worse for the S&P 500 and the Nasdaq, which additionally slumped on Monday and have now each fallen greater than 10 % every from their report highs — a fall that’s recognized in markets as “a correction.”

Cryptocurrencies weren’t spared from the rout, with Bitcoin down 5% to round $34,000.

Worries about rising tensions in Ukraine, the place Russian troops are massed on the borders, contributed to the declines.

However in the end, the fears are being pushed by the latest surge in inflation to 40-year highs, which would require the Federal Reserve to boost rates of interest with the intention to cool costs.

Why the outlook is so unsure

How the Fed goes about doing that’s difficult, nevertheless.

Larger rates of interest will push up borrowing prices for shoppers and companies, and traders try to determine how onerous that may hit firms.

Elevating charges an excessive amount of may decelerate the financial system excessively. But, elevating them too little raises the alternative concern, that they are going to fail to make an excessive amount of of a dent on inflation.

In the mean time, Wall Road is anticipating the Fed to boost rates of interest 4 instances this yr, probably beginning as early as March. In some unspecified time in the future, the Fed can be anticipated to start promoting property — together with bonds and securities tied to mortgages — they purchased through the pandemic to prop up markets and the financial system.

In a brand new analysis notice, economists at Goldman Sachs stated they anticipated the Fed to boost rates of interest 4 instances. However they added a notice of warning that the Fed may elevate rates of interest extra aggressively if inflation stays excessive, a course of recognized in markets as coverage tightening.

“We see a danger that the FOMC will need to take some tightening motion at each assembly till that image modifications,” Goldman stated in a notice, referring to the Federal Open Market Committee (FOMC), the group that takes rate of interest choices on the Fed.

Apples grown within the US are seen on the market at a grocery store in Glendale, Calif., on Jan. 12. Client costs surged 7% in December, the quickest annual tempo since 1982.

Robyn Beck/AFP through Getty Photos

disguise caption

toggle caption

Robyn Beck/AFP through Getty Photos

Apples grown within the US are seen on the market at a grocery store in Glendale, Calif., on Jan. 12. Client costs surged 7% in December, the quickest annual tempo since 1982.

Robyn Beck/AFP through Getty Photos

Tech firms are routed

The uncertainty behind rates of interest has hit know-how firms particularly onerous, together with Meta, Fb’s dad or mum firm, and Alphabet, which owns Google.

Shares of know-how firms are likely to do finest in high-growth economies and fewer so when charges begin to climb.

Inflation additionally eats into future earnings, and traders are recalibrating their expectations after know-how share costs surged over the previous few years.

After all, it is onerous to foretell the trajectory of inflation, which means the uncertainty in inventory markets may proceed for some time.

Most analysts nonetheless anticipate inventory markets to realize this yr after rising in every of the earlier three.

However beneficial properties will not be fairly as robust as lately. Shares truly surged through the pandemic as shoppers went on a purchasing spree, whereas thousands and thousands of newbie traders joined markets for the primary time.

A whole lot of what occurs will hinge on the progress of inflation, the financial system and company earnings.

The Fed meets on Tuesday and Wednesday, and Fed policymakers are anticipated to share new particulars about their plans to boost rates of interest, though no significant motion is anticipated.

On Friday, the Commerce Division is ready to report a number of financial indicators together with on client spending in addition to on inflation.

In the meantime, a slew of firms together with Microsoft and Apple are set to report earnings this week for the final three months of 2021, and traders can be eager to see how company earnings held up throughout a interval marked by excessive inflation, provide chain woes and staffing shortages.

Michael Wilson, the chief U.S. fairness strategist and chief funding officer at Morgan Stanley, says he’s going to pay shut consideration to how every firm has been performing, and the way executives are dealing with greater prices.

Like tech firms, shares which have been pushed excessive by hypothesis could proceed to fall, he stated.

“The froth is popping out of an fairness market that merely received too prolonged on valuation,” Wilson wrote in a notice to shoppers.