A paradox lies at the heart of smart contract-enabled blockchain networks.

They are democratic (distributed), tamper-free (immutable) and transparent, but in order to realize anything close to their real potential, they must connect to the physical world. This imperative makes them subject to some of the vulnerabilities that blockchain technology was designed to surmount — including centralization and opacity.

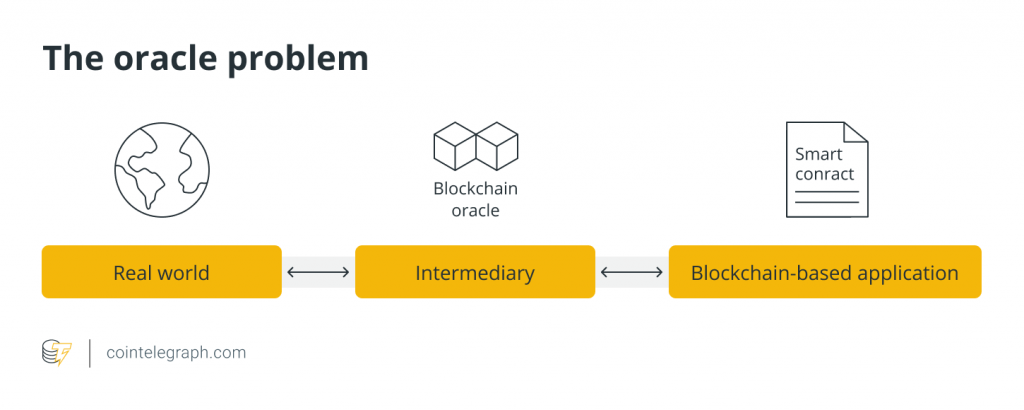

Blockchain oracles are the means by which real-life data — like football scores, rainfall measurements or election results — are transmitted to a blockchain. Imagine that Alice and Bob wish to place a wager on the outcome of a horse race. How would the smart contract know who to give the winnings to? An oracle can retrieve the information from the real world and deliver it onto a blockchain.

Oracles are particularly critical for the emerging DeFi sector, given its need for secure price information to ensure that actions such as liquidations and prediction market resolutions work smoothly. “Fundamentally, oracles aim to answer the simple question: How can off-chain data be securely reported on chain?” notes a recent book, DeFi and the Future of Finance.

As the world moves toward Web3 — i.e., third-generation internet, where decentralized solutions are expected to dominate — oracles will likely become more prominent, Joe Petrowski, technical integrations lead at the Web3 Foundation, tells Magazine. Oracles will be needed to inform decisions and also, perhaps, enforce decisions. Their uses, too, are projected to go beyond providing price feeds for DeFi protocols and event outcomes for prediction markets.

Blockchains using sensors as oracles could support the enforcement of international treaties, for example, including limits on greenhouse gas emissions, wrote NYU’s Yannis Bakos and Hanna Halaburda recently. This is particularly the case since the technology “guarantees that information provided from sensors and oracles has not been tampered with after it is recorded on the blockchain.” Its transparent, immutable ledgers can be used to fight government corruption and become a tool to restore forests and authenticate supply chains, as well as many other uses.

A critical quandary

But all this promise can still only be discussed in the conditional sense because blockchain data becomes tamper-free only “after it is recorded” on the ledger, as the NYU professors noted. Who or what authenticates data before it is uploaded onto the chain? This, in a nutshell, is the oracle problem — once described by Jimmy Song as the “intractable problem in linking a digital to a physical asset whether it be fruit, cars or houses at least in a decentralized context.”

Song explained this oracle quandary in simple terms using the example of a transfer of homeownership recorded on a blockchain:

“When Alice transfers the house to Bob, the smart contract needs to know that she actually transferred the house to Bob. There are several ways of doing this but they all have the same essential problem. There has to be some trust in some third party to verify the events in the physical world.”

The oracle problem “is a crucial problem for blockchain economies,” Halaburda, who is an associate professor at NYU’s Stern School of Business, tells Magazine. “It is related to the gateway problem of getting information on blockchain — oracle is just one way of getting it there.” Bitcoin and other native cryptocurrencies don’t have this problem, she adds, because they do not represent or refer to anything outside of their own blockchains. But once smart contracts are introduced to the value proposition, everything changes.

“Oracles have made significant progress in empowering the tokenization of physical, real-world assets,” John Wu, president of Ava Labs — which developed the Avalanche public blockchain — tells Magazine. “For example, weather data enables financial services like insurance on physical property or crops, expanding the utility of that asset and value users gain by putting it on-chain.”

The so-called oracle problem may not be intractable, however — despite what Song suggests. “Yes, there is progress,” says Halaburda. “In supply-chain oracles, we have for example sensors with their individual digital signatures. We are learning about how many sensors there need to be, and how to distinguish manipulation from malfunction from multiple readings.”

“We are also getting better in writing contracts taking into account these different cases, so that the manipulation is less beneficial,” Halaburda continues. “In DeFi, we also have multiple sources, and techniques to cross-validate. While we are making progress, though, we haven’t gotten to the end of the road yet.”

Blockchain’s “connective tissue”

As noted, oracles are critical to the emerging DeFi sector. “In order for DeFi applications to work and provide value to people and organizations around the world, they require information from the real world — like pricing data for derivatives,” Sam Kim, partner at Umbrella Network — a decentralized layer-two oracle solution — tells Magazine, adding:

“This is what oracles do — they serve as connective tissue for accessing, processing, and transmitting critical data. Oracles are essential for ensuring the integrity of data in the DeFi ecosystem.”

“Blockchains’ killer application has always been asset tokenization, and oracles have a central role to play in this migration,” adds Wu. Oracles can “unlock key functionality like lending, borrowing, options, derivatives, prediction markets, and sophisticated trading applications.”

But they can go further. “What [oracle solution] services like Chainlink are doing is taking it from just simple price feeds to complex data feeds to enable a much more diverse array of financial products like crop insurance for farmers and agribusinesses to be built as opposed to just simply supporting products and services that exist in the DeFi/Blockchain ecosystem,” Sid Jha, founder and CEO of Arbol and a founding partner of weather oracle dClimate, tells Magazine.

Arbol, for instance, offers parametric crop insurance to farmers in the developing world, protecting against natural occurrences like drought. If a given location in Sudan, say, goes three weeks without any rainfall, an oracle can automatically trigger a smart contract payment to all policy-holding farmers in that area. No on-site damage investigations are launched, and no adjusters are summoned. Payment to mobile devices is almost immediate — which is critical in impoverished areas where farmers are often living hand to mouth.

“When we first started Arbol, there was no industry standard oracle network,” Jha continues. “We started using some other services to secure our smart contracts, but there was no level of decentralization. Having a stable oracle network to rely on for the data-driven, blockchain-powered parametric insurance products we build at Arbol was essential for us because our smart contracts need to be able to interact with real world, external data sources.”

Are multiple data sources the answer?

Some believe the answer to the oracle problem is simply to avoid relying on a single data source, or node. Along these lines, Chainlink’s largest oracle network — its ETH/USD price feed — has 31 nodes, including Deutsche Telekom’s T-Systems and Switzerland’s Swisscom, among others.

The ETH/USD oracle network alone secures over $20 billion of smart contract value. “There are over 700 of these oracle networks” on Chainlink’s platform now, Sergey Nazarov, co-founder of Chainlink, tells Magazine, “and we believe there could be a thousand next year,” although none approaches the size of the ETH/USD feed.

How many nodes are sufficient to secure a smart contract? It depends, says Nazarov. If a user is securing $100,000 on a smart contract, that user could get by using a single data source. The economic risk is relatively low. But say the amount to be secured grows to $10 million. Then, that user might want to have a verified single source. That is, the smart contract has a single data source and a second source that is the circuit breaker to make sure the data flows in correctly, he explains.

What if a user needs to secure $100 million? At that point, “You should make an oracle network with at least seven nodes, you should get at least three data sources each, and you should have an automatic way to switch them out,” Nazarov tells Magazine.

The challenge for Chainlink lies not just in solving the traditional oracle problem, Nazarov continues. Rather, it’s about enabling the security of an oracle network to scale as the security needs of that oracle network’s users grow: “There has to be a consistent interaction between what the users define as decentralization and definitive truth and what the oracle network provides.”

More resilience and diversity needed?

Still, not all are satisfied with the state of things. Online oracles, as they currently exist, “are vulnerable to front-running, and millions of dollars have been lost to arbitrageurs,” wrote the authors of DeFi and the Future of Finance. “Until oracles are blockchain native, hardened, and proven resilient, they represent the largest systemic threat to DeFi today.”

“Decentralized oracles have done a good job in unlocking value for DeFi, but I think the future will see more first-party oracles being utilized in a composable manner to create blockchain-based applications that have oracle use-cases that go way beyond what we currently see in the market,” Heikki Vänttinen, co-founder of API3, tells Magazine.

On the decentralization question, Chainlink is a sort of hybrid, others suggest. It uses multiple data sources for price feeds, so in that sense, it is decentralized. But Chainlink itself decides which data sources to offer — e.g., Swisscom and AccuWeather — and it is the provider to so many DeFi protocols that Vitalik Buterin, along with some others, has called for a “diversity of different approaches” in the matter of oracles, particularly in regard to algorithmic stablecoins. Buterin recommended in May that “Uniswap and the UNI token step in and provide such an oracle.” (Nothing has come of this idea so far, as can best be determined.)

Vänttinen has written about using “first-party oracle data” from sources like flood meters that could be strategically placed in people’s homes. When water levels reach a critical height in a statistically significant number of homes, a smart contract could be triggered to make flood insurance payments automatically. No investigators or adjusters would be needed, and economically pressed households would receive money almost immediately.

Is it really practical to place flood meters in thousands of homes in flood-plagued areas, though?

“All such IoT devices don’t need to be directly connected to the blockchain,” Vänttinen tells Magazine. “You can aggregate the device data off-chain, or use an IoT data network as the intermediary layer.” He adds further:

“The oracle problem becomes a lot less intractable when you consider where the data to oracles actually comes from and count the data provider into the equation. That is, by defining the oracle ‘as a piece of middleware that transports data from source to blockchain,’ you demystify the topic significantly and can use a first-principles approach to providing a solution.”

The insurance industry’s embrace of oracles and blockchain technology has been slow. Many had expected parametric insurance — which often involves smart contracts and blockchain technology — to have taken off by now.

“Parametric insurance is happening,” Nazarov tells Magazine. He’s delivered many talks on the subject over the past five years, and Chainlink is investing heavily in this area. But it takes time, he continues. In the blockchain industry, it’s commonplace that “nothing happens — and then everything happens.” Decentralized insurance might follow the same pattern. “They basically need to reach a tipping point, a certain threshold — at which point they begin to take on a life of their own.”

Easier said than done

Others have said decentralized oracles as currently configured are often sluggish, costly and subject to selection bias.

To this last point, oracles are used in prediction markets to decide the outcome of real-world events, like elections or sports events, and if the truth oracle is decentralized, the “outcome” is often determined by a vote. In that case, “You need to have a group of honest voters,” economist Chuanwei “David” Zou, founding partner at Nanhu Financial Corporation, tells Magazine. By this, he means a group that accurately represents the voting population.

You don’t want a cohort of all Republican or all Democratic voters to determine the outcome of a tight election; rather, you want a representative sample of Republicans and Democrats. This isn’t always so easy to do.

“A truly decentralized oracle network must be one where the data sources are chosen by the community, the validators are elected by the community, and the rules around staking, including rewards and slashing penalties, are also set by the community and not by a central authority,” adds Umbrella’s Kim. “The ideal way to ensure that oracle nodes operate independently and with integrity is for the oracle itself to employ a delegated proof-of-stake (DPoS) consensus model on its own blockchain.”

Are oracles critical for blockchain?

To what extent does the future of blockchain technology depend on its ability to develop trusted, tamper-free oracles of truth?

“It’s crucial, if we want the blockchain to be useful for anything other than native assets (e.g., native token, like Bitcoin for the Bitcoin blockchain),” says Halaburda, while Jha adds: “If you don’t have trustworthy external data, you can’t take advantage of the full power of blockchain. […] If a blockchain can’t connect to the real world, it’s like having a computer without the internet.”

“As the market starts to mature, and both DApps and their respective user bases start to look for more sophisticated applications, data representing title and ownership of real estate, intellectual property and other physical and non-physical assets will begin to emerge,” says Kim. “And thus oracles will be well-positioned to provide the bridge between off chain and on chain as these emerging applications are deployed and gain adoption.”

There are other areas where blockchain technology can make a big difference, like validating educational degrees, but decentralized oracles are probably not going to be at hand anytime soon, so the industry may just have to make do with centralized oracles. “Decentralized oracles work great for information that is verifiable from many different sources — e.g. getting price pairs from different exchanges/data providers,” Joshua Ellul, a senior lecturer at the University of Malta and director of its Centre for Distributed Ledger Technologies, tells Magazine.

However, in higher education, data is very centralized, and “The University can attest to a student’s certificate and only that University,” he adds.

Web3 and beyond

As the world moves toward Web3, some believe that the human element can and should be removed from governance decisions in key technologies, including oracle technology. This may be naive.

People sometimes lose sight of the fact that algorithms are created by human beings, says Petrowski, and that “They don’t eliminate bias — they just hide it.” While purists might like to have everything decentralized and automated — a world where software code “rules” — blockchain oracles might still require some degree of human oversight to guard against selection bias and other potential problems.

Moreover, it would be a great loss if blockchain oracle technology never evolves much beyond providing price feeds for DeFi projects, adds Petrowski:

“We can do so much more than a spreadsheet with technology like this. If it is restricted to prices and data, it would be a big loss of opportunity.”

Petrowski can imagine a blockchain-based satellite registry, for example, that would manage the launching of satellites on a global scale, with some resource allocation capability. He can envision something like a Grand Oracle Committee — a group composed of academics, judges and journalists, among others, to help decide some of the fuzzier oracle cases and to ensure that one country or group doesn’t snatch up all the registrations, for instance.

Others believe oracles and blockchain technology are now at an inflection point. “The launch of blockchains and smart contracts has demonstrated tremendous potential for the building of new business models,” said former Google CEO Eric Schmidt, who recently signed on as a strategic adviser to Chainlink, “but it has become clear that one of blockchain’s greatest advantages — a lack of connection to the world outside itself — is also its biggest challenge.”

One of the decade’s “most important technologies”?

Many anticipate escalating demand for oracle technology. Indeed, former Coinbase chief technology officer Balaji Srinivasan said recently that crypto oracles are “going to be one of the most important technologies of this decade.” Is that going too far?

“I completely agree” with Srinivasan, Nazarov tells Magazine. “Oracles will take us from a world of weak trust assumptions to a world powered by cryptographic truth — which is a better world for everybody.”

Looking ahead, “The need to transfer information like rainfall data to help farmers in rural areas is huge,” says Jha. “These applications have value in the real world, and oracles will be essential for ensuring the integrity and security of the data underlying all up-and-coming blockchain-based projects that have real world utility and application.”

What’s clear is that in a world where anyone can say anything on any subject — and with the push of a button, broadcast it around the globe — society has an urgent need for reliable arbiters of truth. Many oracles will be decentralized, but not all, and certainly not all at once. They are likely to evolve beyond the decentralized finance and prediction markets, too, securing smart contracts in areas as disparate as the environment, education, supply chains and even international politics.

The process is not likely to be fully automated, either. At some point, human beings will have to intervene — to decide who or what is a worthy “oracle node” (i.e., data source), if nothing else.