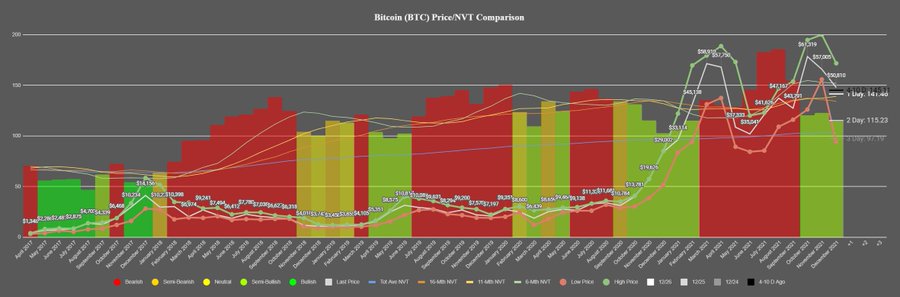

Santiment believes that Bitcoin is still in a semi-bullish area, given that circulation continues to be steady.

The on-chain metrics provider explained:

“Bitcoin continues to circulate in the semi-bullish territory, according to our latest NVT model data. With BTC back under $50K, circulation staying steady is encouraging to see, as it implies utility is remaining at a justifiable level vs. market cap.”

Over the Christmas weekend, Bitcoin (BTC) was able to hold above the psychological price of $50K, given that the top cryptocurrency has been ranging between the $47K and $51K area since it gained momentum after slipping to lows of $42,000 on December 4.

Market analyst Will Clemente had previously noted that Bitcoin had to reclaim the $53,000 area before a bull run to be reignited.

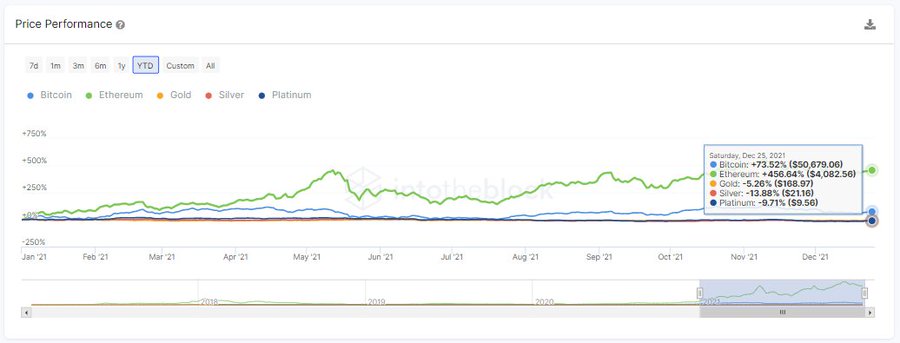

Meanwhile, Bitcoin has significantly outperformed gold in 2021. Data analytic firm IntoTheBlock confirmed:

“Bitcoin and Ethereum broke their previous ATH in 2021, appreciating by 71.8% and 456%, respectively. During the same period, Nasdaq and S&P 500 had positive yearly returns of 26.54% and 25.82%. Moreover, BTC has vastly outperformed GOLD, which had an ROI of -5.26%.”

American billionaire investor Ray Dalio recently noted that Bitcoin was almost a younger generation’s alternative to gold, which has imputed value.

Bitcoin is often considered as the millennial’s version of gold. Industry experts have correlated Bitcoin with millennials because they are prone to adopting crypto-assets and tech stocks, while older investors tend to favour gold.

A recent CNBC survey indicated that millennials had higher levels of cryptocurrency portfolio holdings than baby boomers, with 83% of millennial millionaires owning digital assets. Furthermore, 48% of them eyed increasing their crypto investments in 2022, with only 6% anticipated to decrease their holdings.

Image source: Shutterstock