Bitcoin, the world’s largest cryptocurrency by market cap, tumbled under the $45,000 worth degree this morning, resulting in a market-wide worth carnage consequently.

Knowledge additional reveals over $328 million value of crypto positions have been ‘liquidated’ this morning, with over 87,000 particular person buying and selling accounts affected. The market, nevertheless, appeared to quickly stabilize at press time, placing a cease to what was the second sudden drop in as many weeks within the crypto market.

Come and gone

‘Liquidations,’ for the uninitiated, happen when leveraged positions are routinely closed out by exchanges/brokerages as a “security mechanism.” Futures and margin merchants—who borrow capital from exchanges (often in multiples) to position larger bets—put up a small collateral quantity earlier than putting a commerce.

In traderspeak, ‘longs’ happen when buyers are betting on costs of a sure asset to rise, whereas ‘shorts’ happen when they’re betting towards that asset.

Bitcoin ‘longs’ took a bulk of these liquidations this morning, information from analytics instrument Bybt reveals. $93 million value of Bitcoin futures positions have been liquidated, with $62 million—65% of all merchants—of these being longs.

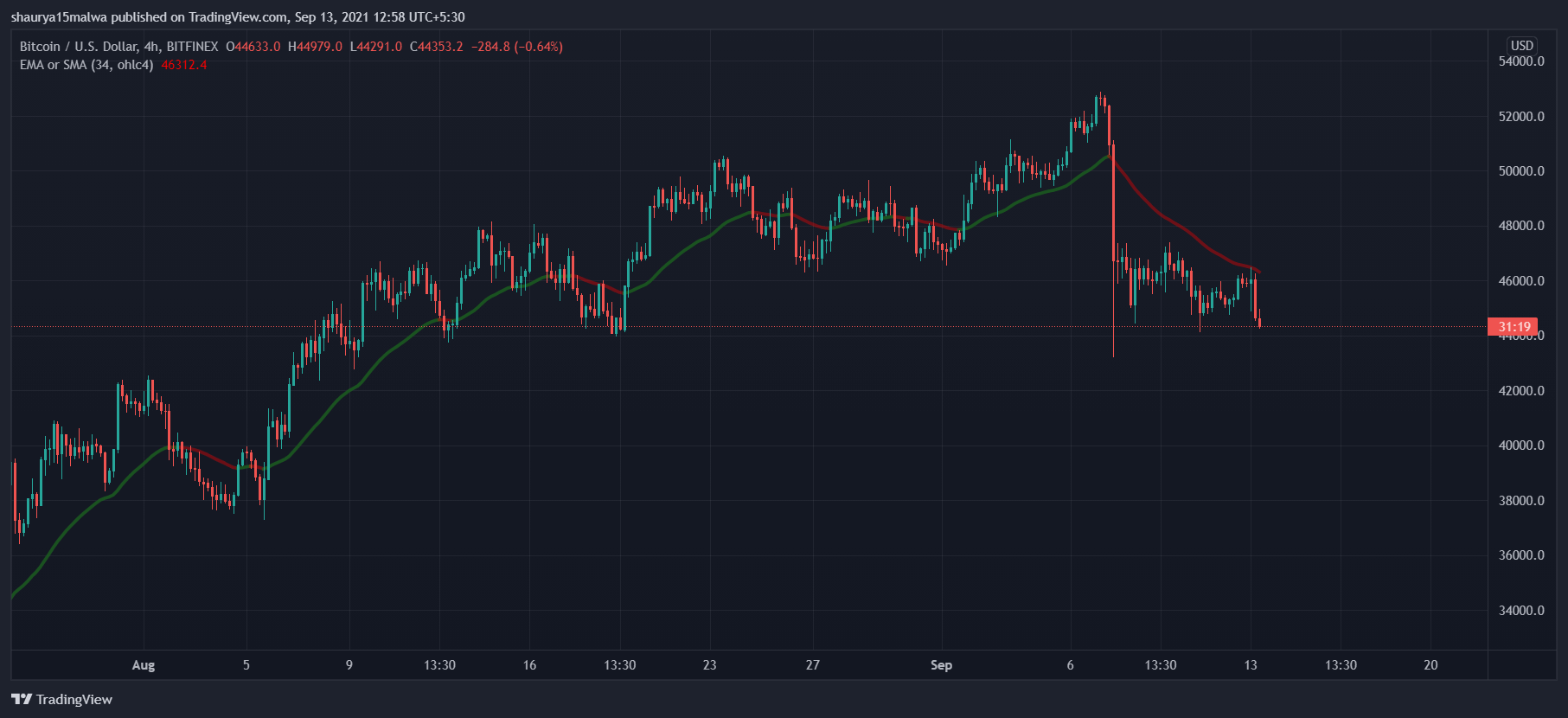

The general development appears to have barely shifted as effectively. Because the under picture reveals, Bitcoin broke under its $46,800 assist to achieve its present $44,200 assist degree. It has misplaced 13% of its worth prior to now week alone, and has the following ‘assist’ degree at $40,000 ought to costs fall additional downward.

By way of different cryptocurrencies, subsequent in step with liquidations was Ethereum—with over $47 million value of liquidations on ETH longs, accounting for $70 million in all. Solana, Cardano, Polkadot, and XRP adopted ETH, with $26 million, $22 million, $12 million, and $10 million value of liquidations respectively.

As such, Bybit took a bulk of all liquidations with $103 million, adopted by Binance at $97 million, OKEx at $69 million, and FTX at $49 million.

Get an edge on the cryptoasset market

Entry extra crypto insights and context in each article as a paid member of CryptoSlate Edge.

On-chain evaluation

Worth snapshots

Extra context

Be a part of now for $19/month Discover all advantages