Ramping up

The narrative

Key U.S. Securities and Exchange Commission (SEC) officials mentioned enforcement around crypto projects earlier this month: Chair Gary Gensler and Director of Enforcement Gurbir Grewal.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Why it matters

We’ve spent literal years interpreting statements from SEC officials to determine how the agency might approach crypto. This month, Gensler and Grewal mentioned crypto in the context of enforcement actions, which might just be a coincidence, but could also be a signal for those looking for more concrete action.

Breaking it down

SEC Chairman Gary Gensler spoke to the Securities Enforcement Forum at the start of the month, quoting predecessor Joseph Kennedy on “making war without quarter” against those who violate federal law.

This ideal holds today, according to the current head of the agency.

“We will continue to pursue misconduct wherever we find it. That will include the hard cases, the novel cases, and, yes, the high-impact cases — whether in special purpose acquisition companies; cyber; crypto; or private funds; whether accounting fraud, insider trading, or recordkeeping violations. I know, recordkeeping violations might come as a surprise. While these may not grab the headlines, the underlying obligations are essential to market integrity, particularly given technological developments,” Gensler said.

Grewal, the relatively new enforcement chief, similarly mentioned crypto in comments made as part of a keynote address.

“But these days, most often in the context of crypto matters and our investigations of certain ESG – or environmental, social, and governance – related products and services, we hear that we should avoid ‘regulation by enforcement,’” Grewal said.

I’m not really sure whether these mentions are now cursory, included because everyone’s talking about crypto these days, or if they’re part of a broadening effort to encompass crypto in the SEC’s work.

What I do know is we’re seeing piecemeal actions from the agency against various crypto projects, mainly alleged frauds or alleged securities registration violations. There still isn’t any binding or bright lines guidance on what startups should do if they want tokens to be a significant part of their projects.

To be clear, we should distinguish between crypto projects that are (a) blatant money grabs designed to defraud people, (b) projects that make a legitimate effort to accomplish their goals and cannot due to technical or circumstantial reasons beyond their control, and (c) projects that actually succeed at their goals, at least for the purposes of this column.

The SEC has mostly focused on categories (a) and (b).

Agency officials often say they want to encourage innovation – in his Nov. 8 remarks, Grewal said the SEC welcomes new tools for capital formation. Still, he included the equally common warning that securities should be registered.

“But – equally importantly – all securities offered or sold to U.S. investors – regardless of their form or name – must comply with the U.S. securities laws. The purpose here is to protect investors and the integrity of our markets by ensuring that investors are provided proper disclosures and the products are subject to regulatory scrutiny,” he said.

Anyways, I’m curious to see if or how the SEC might respond to the ConstitutionDAO refund situation and whether there’s an applicable lesson here.

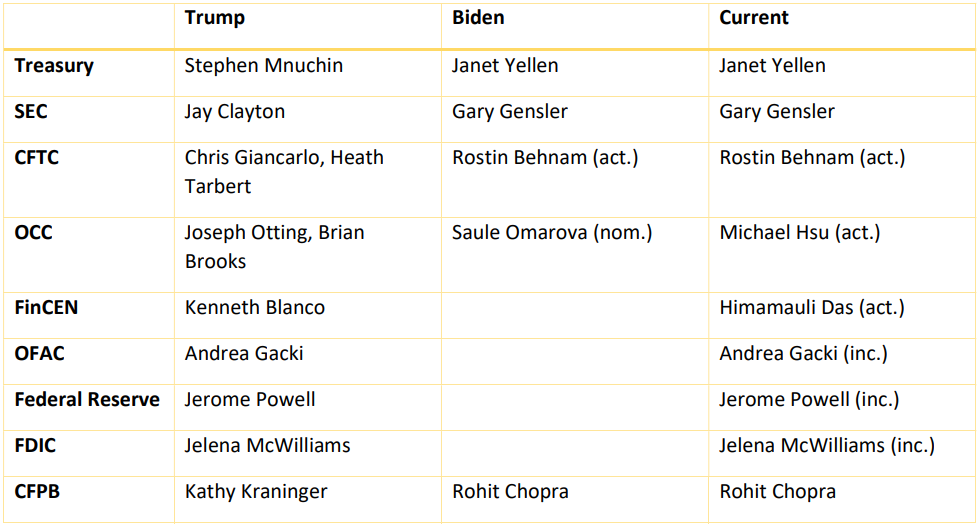

Biden’s rule

Changing of the guard

U.S. President Joe Biden announced he would nominate Federal Reserve Chairman Jerome Powell to a second term heading the U.S. central bank, and Boston Fed Governor Lael Brainard to be vice chair. Biden pointed to Powell’s actions during the pandemic, as well as his possible focus on climate change and actions around current inflation in a statement announcing the nomination.

“[Powell’s] also underscored the importance of the Fed taking a more proactive role in the months and years ahead in making sure that our financial regulations are staying ahead of emerging risks, be they from innovations in cryptocurrency or the practices of less regulated non-bank financial institutions,” Biden said in remarks on Monday.

Elsewhere:

After Being Foiled by a Billionaire, ConstitutionDAO Faces Lingering Questions: There’s a certain irony to the fact that Citadel CEO Ken Griffin outbid ConstitutionDAO to purchase a copy of the U.S. Constitution. What a wild week.How Misinformation on ‘Book Twitter’ Killed a Literary NFT Project: My colleague Cheyenne Ligon took a look at the “Realms of Ruin” NFT storytelling project that died before it launched after an immense backlash against the authors organizing it.

Outside CoinDesk:

(Gyges Lydias) Several crypto firms have published their views on what policy around digital assets should look like in the U.S. Gyges Lydias, a possible current-or-former regulator or Congressional employee, details how these proposals might make their way into becoming actual law.(Vice) “‘Buy the Constitution’ Aftermath: Everyone Very Mad, Confused, Losing Lots of Money, Fighting, Crying, Etc.” That’s definitely a headline.(Bloomberg) Matt Levine is always a must-read but his analysis of El Salvador’s bitcoin bond is very clear for those of you who, like me, missed this part of the weekend.

After the Patriots-Falcons game tonight, there will be a 3-hour, 28-minute partial lunar eclipse, according to NASA. It’ll be the longest partial lunar eclipse in 581 years. That one also lasted 3 hours, 28 minutes. pic.twitter.com/1Dal9rFhbO

— Jeff Howe (@jeffphowe) November 18, 2021

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!