Over the last seven days, decentralized exchange (dex) trade volume has tapped $17 billion across the 21 Ethereum dex platforms. Pancakeswap has seen between $400K to $860K every 24 hours during the last week as well. Meanwhile, dex aggregators are eating away at dex trade volumes, becoming more popular by the day.

Uniswap Commands Top Dex Trade Volume, Aggregation APIs Capture a 22% Share of Ethereum-Based Dex Volumes

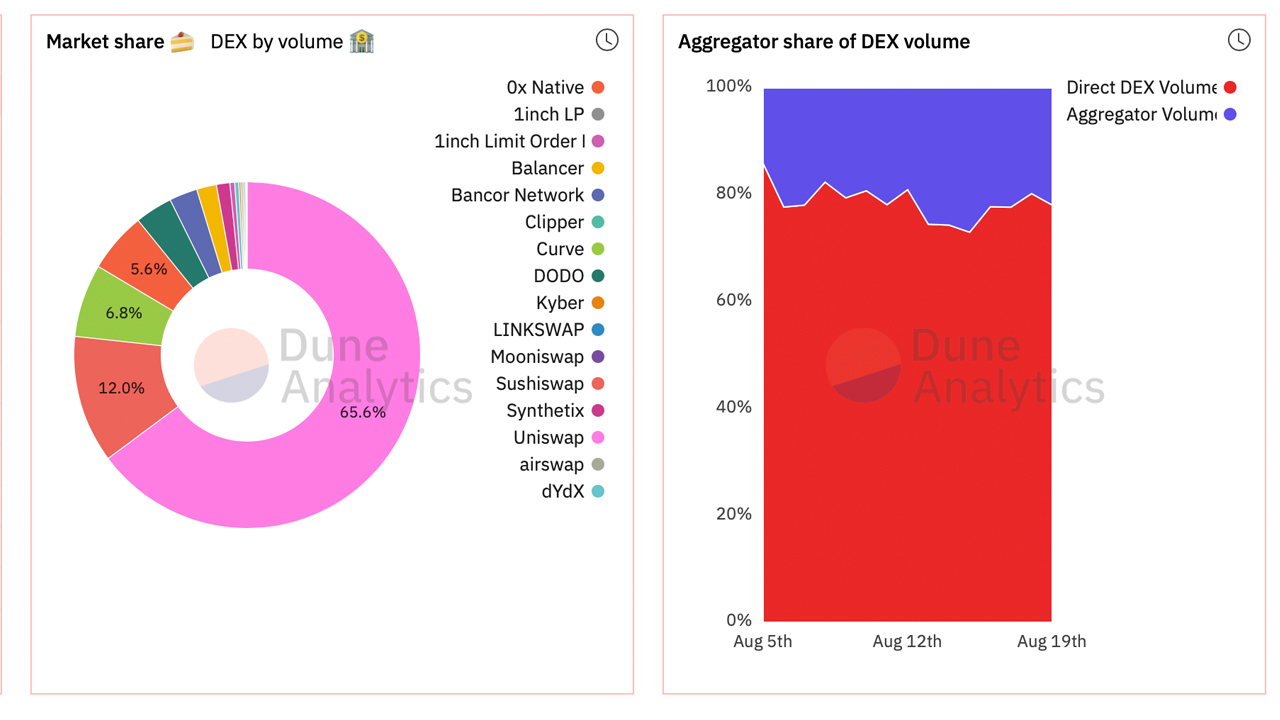

Decentralized exchange (dex) trading continues to see billions of dollars in swaps every week. During the last seven days, dex trade volume has tapped $17 billion across 21 Ethereum-based dex platforms. Over the last 24 hours, the 21 dex platforms saw $2.95 billion in global swaps and dex aggregators captured $3.8 billion in 24-hour volume. Dex aggregators like 1inch share around 22.7% of the dex trade volumes today, according to stats from Dune Analytics.

Meanwhile, Pancakeswap, the Binance Smart Chain (BSC) dex, has seen between $400K to $860K every 24 hours during the last week as well. Some of the largest trading pairs on Pancakeswap on Thursday include CAKE, WBNB, ETH, and USDT. Uniswap is the largest dex today out of the 21 Ethereum-based decentralized exchange volumes recorded on Dune Analytics. Out of the aggregate total of $17 billion, Uniswap captures 65.6% or over $11 billion in global swaps during the week.

Top Five Dex Aggregation Platforms Today Include 1inch, 0x API, Matcha, Paraswap, Tokenlon

Uniswap is followed by Sushiswap which captures $2 billion or 12% of the seven-day dex trade volumes. Sushiswap is followed by Curve ($1.5B), 0x Native ($946M), Dodo ($585M), Bancor ($433M), and Balancer ($303M). Seven-day statistics show that Uniswap has the highest number of traders (or unique addresses) with 135,851 recorded on Thursday. This is followed by 1inch (34,842), Sushiswap (22,820), 0x API (17,627), Paraswap (5,297), and Matcha (4,154).

Aggregators have been eating into the trade volume as the platforms allow users to choose between multiple dex protocols and search for the best trades. Currently, the top dex aggregator is 1inch, followed by 0x API. These two dex aggregation platforms are followed by Matcha, Paraswap, and Tokenlon. This week, the top dex aggregator 1inch revealed it was introducing optimistic rollup technology to reduce fees and network congestion.

What do you think about the top dex platforms and the seven-day trade volumes captured this week? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.