Bang! Went the gavel at Sotheby’s public sale home on Could 18, 2017. It was a historic evening. Untitled, a portray by Jean-Michel Basquiat, had simply bought for $110.5 million — a brand new file for the costliest paintings by an American artist.

The COVID-19 pandemic dampened effective artwork gross sales, however the trade is coming again. Simply two weeks in the past, a lesser-known Basquiat portray, Warrior, bought for $41.9 million. Wonderful artwork has been a dependable asset class for hundreds of years. Restricted provide is a strong factor. And within the minds of many, one of the best works are priceless.

Actually, shopping for one of the best of any asset class tends to be a house run. In January, a Mickey Mantle baseball rookie card bought for a staggering $5.2 million. First-edition Pokémon playing cards from the late Nineties have seen their values surge — with some up tenfold in the previous few years. In late 2020, a first-edition holographic Charizard Pokémon card in mint situation bought for $360,000.

Moreover, the rise of non-fungible tokens (NFTs), which show possession of a digital asset, within the type of LeBron James highlights or Jack Dorsey’s first-ever tweet, have spurred a brand new type of gathering.

Bitcoin has emerged as one of the best in its asset class, too. Its meteoric positive aspects eclipse rival cryptocurrencies’ in a similar way to top-tier artworks and buying and selling playing cards.

Investing in one of the best in breed of any asset class is usually a noble endeavor. However the penalties for choosing mistaken will be catastrophic. Cryptocurrency, effective artwork, and buying and selling playing cards are attention-grabbing funding selections, however are inherently riskier than shopping for shares.

Here is why shares are one of the best asset class for predicting future worth and driving long-term wealth.

Picture supply: Getty Photographs.

Publicly traded corporations encompass our on a regular basis lives

Behind each inventory is an organization. We encounter many of those corporations every day. Whereas it might be exhausting to grasp an trade you are unfamiliar with, it is easy to see that lengthy strains at Chipotle Mexican Grill are a tell-tale signal enterprise is doing effectively.

Walt Disney (NYSE:DIS) is among the most relatable latest examples. Whereas the pandemic plummeted park and studio leisure income, tens of tens of millions of parents subscribed to Disney+. Whether or not it was entertaining children caught at house or catching the most recent episodes of The Mandalorian, the rise of Disney+ in 2020 was a development that was pretty simple to see coming. The outcomes converse for themselves: Shares of Disney have doubled over the past yr and are actually inside hanging distance of an all-time excessive.

Disney is not the one instance. Removed from it. Chances are you’ll be studying this text on an Apple gadget, or one produced by Alphabet‘s Google. I wrote this text utilizing Microsoft Phrase. There’s additionally a very good likelihood you handed by a McDonald’s or Starbucks right now. Cleaned dishes or did laundry with Procter & Gamble merchandise. Adjusted the temperature of your own home with a Honeywell thermostat. Financial institution with JPMorgan Chase. Obtain packages from FedEx. Finish your evening watching Netflix.

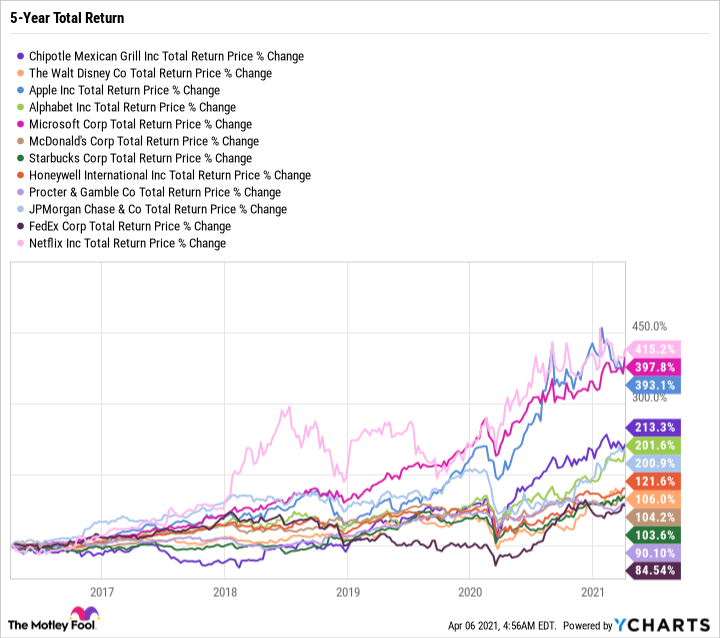

The listing goes on and on. Here is how these corporations carried out over the past 5 years.

CMG Whole Return Value information by YCharts

Shares are liquid property

One of many greatest benefits that shares have over different asset courses is liquidity. Not solely is it tough to decide on the appropriate artwork to spend money on, you even have to keep up the standard of the artwork, presumably pay for insurance coverage, and shield in opposition to theft. Artwork will be exhausting to promote, and costs can range wildly.

The identical goes for buying and selling playing cards. Bend, or a lot as smudge, a prized card and the worth could lower by 90%.

Shares are the alternative. There is a slender unfold between the bid and the ask worth.

The fantastic thing about the inventory market is that folk such as you and me can turn out to be partial house owners in companies that we like and imagine will likely be profitable for years to come back. Whereas a few of our favourite corporations could also be costly buys, there are methods to make them extra inexpensive. Fractional shares make it simpler to buy a stake in excessive nominally priced shares like Amazon.

Moreover, many brokerages now supply free on-line buying and selling, when only a decade in the past, charges could possibly be as excessive as $10 per transaction. Turning shares into money or money into shares is now easy and free.

One of many greatest developments over the past yr has been a surge in housing costs. Whereas having a house recognize in worth will be good, promoting additionally means discovering a brand new place to reside. The effort of shifting and piles of paperwork is usually a pressure, to not point out your loved ones might not be eager on leaping round from metropolis to metropolis in pursuit of a fast buck.

Securities that spend money on actual property resembling an actual property funding belief (REIT) are a way more liquid different. REITs supply comparable benefits to shares.

Picture supply: Getty Photographs.

Investing with confidence

Many people comply with sports activities and even watch our favourite groups often. However will we win our fantasy leagues yearly? Or actually know if a rookie Magic Johnson card is extra worthwhile than a rookie Larry Chicken? Laborious to say. We could recognize effective artwork, but it surely would not pervade our every day lives like many corporations do. And what edge do we’ve got over skilled collectors who attend galleries on a weekly foundation?

Since we’re accustomed to many corporations and may see their success unfolding proper earlier than us, it is simpler to be assured that they may proceed to be helpful and worthwhile 10 years from now.

Peter Lynch, certainly one of my favourite buyers of all time, believed that folk with out a finance or accounting background can earn cash within the inventory market by merely investing in companies they perceive. You possibly can have by no means owned inventory in your life and nonetheless have an edge over Wall Avenue by investing in an trade you realize and love.

Investing in a enterprise you perceive conjures up confidence. So does the long-term monitor file of U.S. shares, which is healthier than bonds, money, commodities, international markets, and foreign money. The S&P 500 is chock-full of losers, but has averaged a return of roughly 7.5% over the long run.

Picture supply: Getty Photographs.

It is OK to be late

Among the market’s greatest winners have been family names for years if not a long time. In case you had purchased $3,000 value of Netflix (NASDAQ:NFLX) inventory in 2005, it will be valued at over $1 million right now. However Netflix’s success wasn’t so apparent again then.

Digital streaming started taking kind in 2007. By 2010, Netflix was a family identify. The inventory has gone up over 60-fold since then. Nonetheless, digital streaming was largely unproven and there have been questions surrounding Netflix’s international rollout.

What about in case you had invested in Netflix in 2015? It might shock you to listen to that investing $1,000 in Netflix at the beginning of 2015 would have became over $5,000 right now.

For years, there was doubt that any U.S. company could possibly be valued at over $1 trillion. Right this moment, there are greater than 4, together with Apple being value over $2 trillion {dollars}.

Winners carry on profitable, and plenty of of them are hiding in plain sight.

This text represents the opinion of the author, who could disagree with the “official” suggestion place of a Motley Idiot premium advisory service. We’re motley! Questioning an investing thesis — even certainly one of our personal — helps us all suppose critically about investing and make choices that assist us turn out to be smarter, happier, and richer.

n fool.insertScript(‘facebook-jssdk’, ‘//connect.facebook.net/en_US/sdk.js#xfbml=1&version=v2.3’, true);n fool.insertScript(‘twitter-wjs’, ‘//platform.twitter.com/widgets.js’, true);n rnrnSource link “,”author”:{“@type”:”Person”,”name”:”admin”,”url”:”https://cryptonewsbtc.org/author/admin/”,”sameAs”:[“https://cryptonewsbtc.org”]},”articleSection”:[“Bitcoin”],”image”:{“@type”:”ImageObject”,”url”:”https://cryptonewsbtc.org/wp-content/uploads/2021/04/gettyimages-565879611.jpg”,”width”:2127,”height”:1409},”publisher”:{“@type”:”Organization”,”name”:””,”url”:”https://cryptonewsbtc.org”,”logo”:{“@type”:”ImageObject”,”url”:””},”sameAs”:[“https://www.facebook.com/jegtheme/”,”https://twitter.com/jegtheme”,”https://plus.google.com/+Jegtheme”,”https://www.linkedin.com/”]}}

Source link