Eoneren/E+ through Getty Photos

Background and Thesis

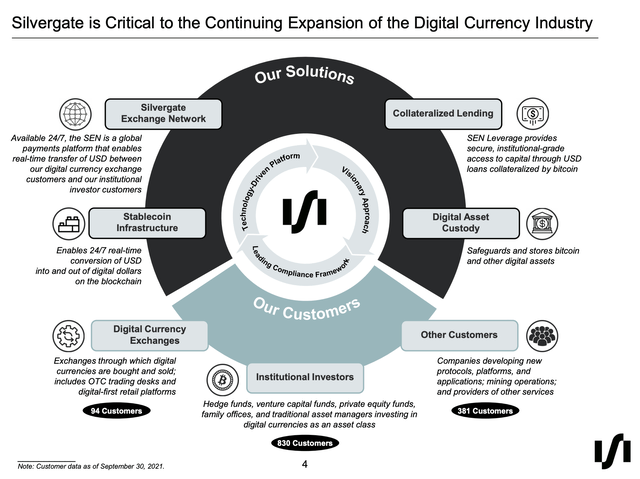

Silvergate Capital (SI) is a number one monetary infrastructure supplier of cryptocurrency options for institutional and business clients.. Cryptocurrency and the decentralization of Trendy Financial concept will give new financial enlargement. The worth of cryptocurrency comes from the blockchain, a community that builders work on. The number of monetary engineering on these platforms offers technique to excessive yield steady cash and different excessive yielding DeFi property. These give traders steady yields that can generate 3-4% greater than T-bonds. This theme will shortly improve the adoption of cryptocurrency as an entire. Up to now, the one vital decentralization adoption that has occurred been finished by the President of El Salvador. He has purchased the dip and continues to purchase bitcoin for his international locations sovereign wealth fund. These are all indicators pointing towards mass adoption on a global stage sooner or later.

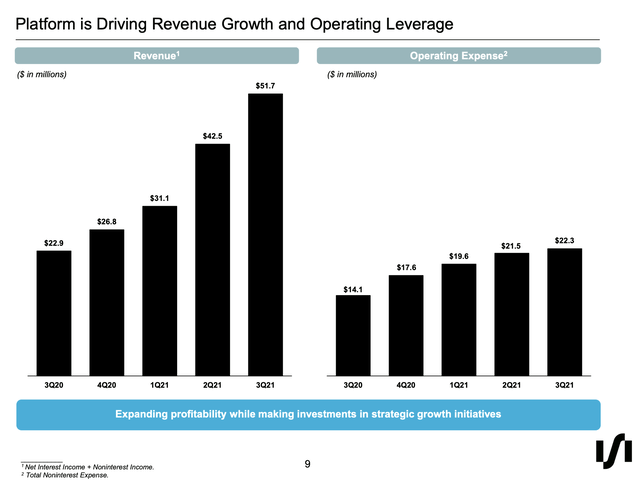

Silvergate Capital November 2021 Investor Presentation

Supply: (Silvergate Capital November 2021 Investor Presentation)

The distinctive ecosystem round crypto will carry new advances within the web3 panorama. Extra institutional traders will need to get into the house as crypto turns into much less unstable. The volatility crush in these property will drive large inflows by property supervisor and excessive web value people alike. The business functions of cryptocurrency could be enormous. The blockchains being constructed at the moment are more likely to be the start of the monetary system that on a regular basis shoppers will work together with sooner or later.

Large TAM and Market Alternative

The large implications of cryptocurrencies TAM can’t be understated. The complete world monetary system has the potential to function by way of blockchain networks. A typical rebuttal I hear from doubters of cryptocurrency’s potential is the excessive price prices on many blockchain networks. Ethereum has excessive ‘gasoline charges’ (transaction charges), making mass adoption at present ranges inconceivable. Nevertheless, it is a wanted a part of the maturity of cryptocurrencies. One of many cryptocurrencies’ foremost spokesman Vitalik Buterin acknowledged that Ethereum (His mission!) just isn’t prepared for mass adoption. That is broadly accepted; nevertheless, it’s laborious to say that.

Silvergate Capital November 2021 Investor Presentation

Supply: (Silvergate Capital November 2021 Investor Presentation)

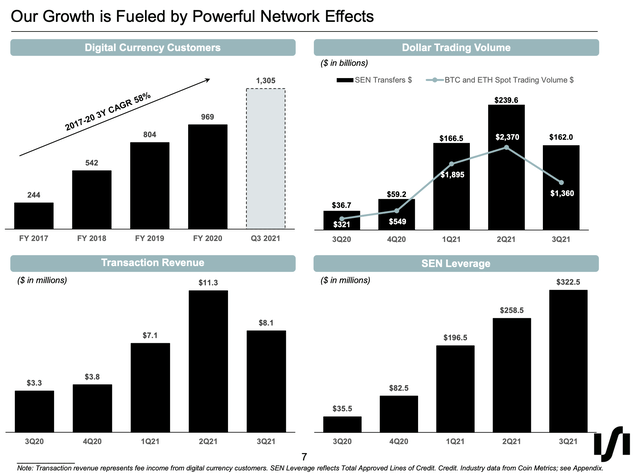

The community results of cryptocurrency will quickly be felt throughout the worldwide economic system. The rising transaction income and rising IPs will straight profit Silvergate’s future progress potential. The greenback buying and selling quantity may also be vital as a result of as crypto turns into the next accepted asset, steady desk cash and fiat currencies will turn into a essential arbitrage unfold for merchants.

Silvergate Capital November 2021 Investor Presentation

Supply: (Silvergate Capital November 2021 Investor Presentation)

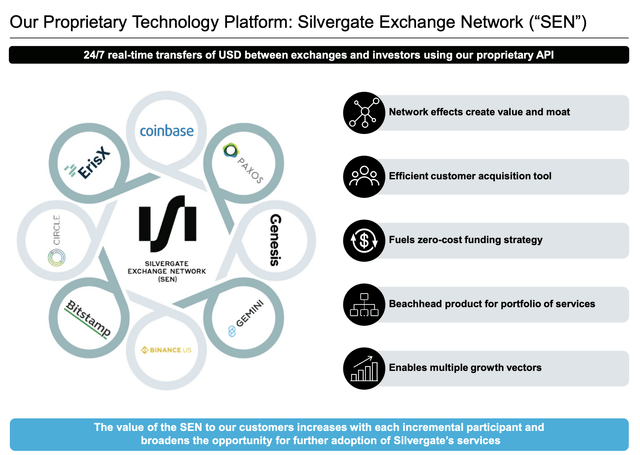

The Silvergate trade community will likely be essential to future success. These brokers are the way forward for crypto as a result of they apply to a variety of demographics. Coinbase (COIN) fields a broader viewers, with many older and youthful traders utilizing the platform to put money into rising recognized currencies. On the similar time, brokers corresponding to Gemini and Genesis are used for lesser-known cryptocurrencies and yield farming. These could be very worthwhile but dangerous endeavors.

Operational Self-discipline and Intelligence

The operations are a big advantage of proudly owning Silvergate. The corporate has many strategic efforts with bigger banks to deepen their cryptocurrency publicity. These efforts will drive elementary progress for Silvergate and increase their partnerships to open up new income streams. Sivlergate can open the eyes to bigger banks on the potential securitization and yield of many cash and the way they relate to fiat currencies. Total the enlargement alternatives are there, and Silvergate has a lot potential enterprise they’ll pivot to and profit from.

Silvergate Capital November 2021 Investor Presentation

Supply: (Silvergate Capital November 2021 Investor Presentation)

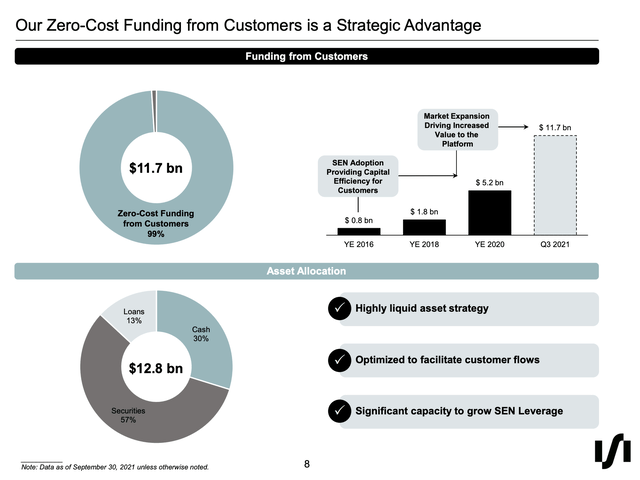

The zero-cost funding technique supplies clients higher entry to crypto with out the charges. This may make investing in cryptocurrencies extra possible for asset managers and hedge funds alike. This volatility crush because of the securitization of the asset will likely be a big boon towards banks and supply a foundation for future 7-8% yields on these steady cash.

Silvergate Capital November 2021 Investor Presentation

Supply: (Silvergate Capital November 2021 Investor Presentation)

Sturdy income progress will likely be important in displaying analysts that Silvergate inventory is legit. With income rising sooner than prices, it is simple to see the scalability of the businesses valuation. Silvergate’s administration is positioning the corporate properly to profit from future coin choices and advances within the web3 house with numerous new enterprise channels on the way in which.

Dangers will stay Excessive On account of Inherent Cryptocurrency Cyclicality

There are inherent dangers within the crypto enterprise. Volatility has been a big downside. Crypto has been crashing over 40% in current weeks. Lately this concern has led traders to dump their cryptocurrency holdings. It is a large mistake as at the moment’s costs will symbolize fractions of the longer term market worth. Silvergate is on the entrance finish of those providers, and the corporate will proceed to dominate the house shifting ahead. Presently, there isn’t a different financial institution as centered on cryptocurrency as Silvergate, and the first-mover benefit will rear its head in future quarters. Extra gamers will likely be on this house, and traders must be ready for future opponents. Whereas there have been few improvements on an institutional stage, there is a superb alternative for the market to increase sooner or later.

Valuation Presents Buyers a Strong Alternative

Silvergate doesn’t have many friends throughout the crypto house, so I selected to worth the corporate towards rising economies or high-growing banks. First Bancorp (FBP) is a Puerto Rico-based financial institution that gives conventional banking providers for retail and business shoppers. The corporate has been raking in stable web earnings and beneficiary of fee will increase worldwide by working on this rising economic system. The following financial institution I select is Fulton Monetary (FULT), a extra steady financial institution that has a 20% income progress fee YoY. Though the corporate is only a regional New Jersey banking company, each firms have seen vital progress charges. Evaluating Silvergate to those extra conventional rising banks places the general beta of crypto into perspective and what the crypto publicity will do to a portfolio. Nevertheless, in occasions like these, it is important to think about the risk-sensitive of those property. Development traders ought to search for long-term stabilizing as adoption comes. This may drive shopper and business adoption. That innovation would be the final leg of progress.

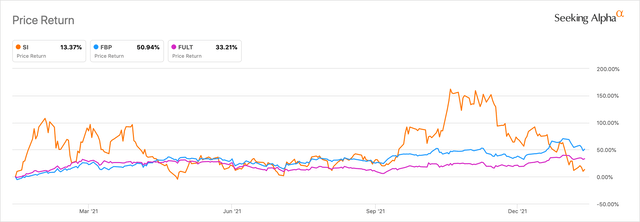

In search of Alpha

Supply: (Silvergate Capital Price Return Peer Comparison)

The value return for all banks has been comparatively constant. Since crypto not too long ago crashed, the corporate’s valuation has come again to earth. Total, banks have carried out fairly steadily. The dividend for each firms has helped stabilize the worth, so they do not have wild swings like Silvergate. Buyers can search for volatility, however total, Silvergate’s yields together with the blockchain. Silvergate would be the first to monetize these property and create new income streams that aren’t baked into the inventory worth. Silvergate will stay worthwhile and proceed increasing within the ever-growing blockchain economic system.

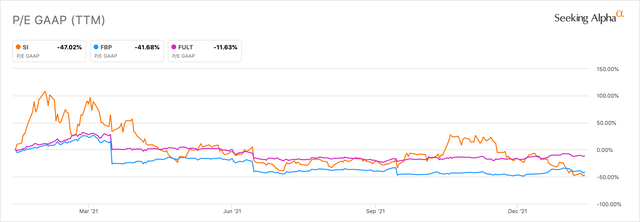

In search of Alpha

Supply: (Silvergate Capital P/E Peer Comparison)

The general P/E compression up to now twelve months could shock traders. Though Silvergate has been present process large swings not too long ago, the corporate has been steadily performing quarter over quarter. Presently, the corporate sports activities a Ahead P/E of 28. Silvergate should not be valued as a standard financial institution. The monetary functions of this expertise will likely be revolutionary to the trade. The early adoption and endorsement of cryptocurrency by Silvergate will likely be a long-term driver for the house typically. I like Silvergate inventory for 2022 because the current worth dip is a superb alternative for progress traders to accumulate shares.

Conclusion and Score

Silvergate is positioning itself very properly to profit from numerous macro traits. These long-term tailwinds will propel shares larger. This may increase the present earnings multiples and improve the general market cap. That is because of the sheer measurement of the market improve. There is a superb alternative to personal shares at a market cap of three billion {dollars} and lots of vital cryptocurrencies dipping. I fee Silvergate a purchase and look ahead to evaluating the corporate’s future progress prospects and earnings studies.