A Tokenised Future for Australia’s Monetary System?

Eventually week’s AFR Crypto Summit, Assistant Governor (Monetary System) of the Reserve Financial institution of Australia (RBA), Brad Jones, delivered a speech exploring the future role of tokenised assets and cash in Australia’s future monetary system and the potential financial advantages.

Historic Classes

Mr Jones highlighted the co-dependence of business and financial methods all through historical past, drawing parallels between the power scarcity of high-value coinage in China’s Music Dynasty and the challenges confronted by European retailers throughout the Renaissance period. In each instances, new applied sciences, similar to paper cash and the printing press, led to revolutionary options for facilitating commerce.

Mr Jones emphasised that the interdependence between commerce and cash continued to drive progress. The commercial revolution, which fuelled world commerce growth, was preceded by varied monetary and financial improvements:

Amongst [those innovations] have been novel types of cash like payments of change, alongside new forms of monetary infrastructure and intermediaries – consider the double-entry book-keeping administered on paper ledgers by the Medicis of Florence. The socio-economic forces unleashed on this interval have been immense: the company was born, capitalism flourished and the brand new service provider class turned a political power. Turning to the computerised age of newer many years, the dematerialisation of finance noticed paper-based types of belongings, cash and file ledgers give strategy to digital variants. This fuelled efficiencies that will need to have appeared unimaginable half a century in the past.

Mr Jones famous that the two-tier financial system comprising the central financial institution and business non-public banks, had confirmed to be extremely efficient in combining the strengths of private and non-private cash. That is the place “tokenisation” comes into play, presenting new alternatives for Australia’s monetary system.

Tokenisation and Its Prospects

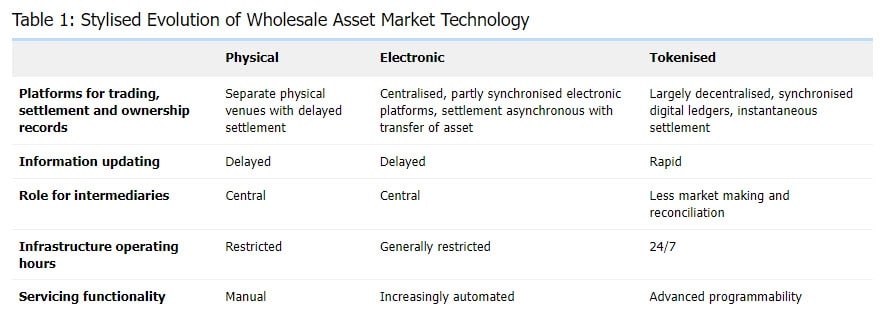

Mr Jones recognized plenty of potential advantages of tokenised belongings, evaluating them to conventional bodily belongings and digital belongings as proven within the desk beneath:

Supply: https://www.rba.gov.au/speeches/2023/sp-ag-2023-10-16.html#fn1

Mr Jones analogised a tokenised asset as:

…digital bearer devices that signify claims on underlying belongings that exist in the true (conventional finance, ‘off chain’) world. In addition they include wealthy, distinctive data that may be up to date instantaneously, and may be programmed through sensible contracts to carry out capabilities that aren’t at the moment carried out in conventional finance functions.

With the power to change tokenised belongings 24/7 on decentralised ledgers, Mr Jones famous that tokenisation could doubtlessly scale back the necessity for intermediaries and handbook file reconciliation.

Having recognized the potential advantages of tokenisation, Mr Jones famous:

threshold coverage query is what potential advantages might tokenisation crystalise, and are the downsides manageable?

Mr Jones recognized the potential advantages together with:

Elevated asset liquidity, informational transparency and auditability;

Decreased dangers, prices, and improved capital effectivity from shorter settlement cycles; and

Decreased middleman and compliance prices.

The challenges included regulatory uncertainty, interoperability between completely different applied sciences (i.e. interactions between distributed ledger know-how like blockchain and different “conventional” data methods), and the affect of prefunding on transactional liquidity.

Regulatory considerations are notably distinguished, as improvements in tokenised finance usually function in a regulatory gray zone. In that regard, Mr Jones highlighted the recent learnings from Australia’s CBDC pilot and opined that enhancements to the regulatory sandbox arrangements in Australia, probably knowledgeable by the UK’s latest expertise, are worthy of consideration.

Tokenised cash

Mr Jones’ speech mentioned the prospects of various types of tokenised cash, which might embrace unbacked cryptocurrencies, asset-backed stablecoins, tokenised financial institution deposits, and a wholesale central financial institution digital foreign money (CBDC). Mr Jones noticed that unbacked cryptocurrencies are dangerous as a result of their worth volatility and lack of regulatory oversight. With respect to stablecoins, Jones famous:

It’s actually believable that stablecoins issued by well-regulated monetary establishments and which are backed by prime quality belongings (i.e. authorities securities and central financial institution reserves) could possibly be extensively used to settle tokenised transactions.

Nonetheless, stablecoins may face collateral limitations and perceived credit score threat.

Tokenised financial institution deposits have been offered as a doubtlessly viable choice for settling transactions, given their similarity to the present banking system.

Contrasting these choices with a wholesale CBDC, Mr Jones acknowledged:

solely a wholesale CBDC could be utterly freed from credit score and liquidity threat. In representing the last word type of protected cash, it might assist to anchor and spur innovation within the monetary system – together with realising the total advantages of atomic settlement and programmability.

Concluding, Mr Jones famous {that a} wholesale CBDC would signify an evolution slightly than a revolution for Australia’s two-tier financial system. He didn’t, nevertheless, go on to think about the prospect of a retail CBDC and the potential coverage challenges which can come up in implementing one, similar to privateness considerations.

Hypothetical price saving of asset tokenisation

Mr Jones quantified a few of the hypothetical cost-savings that asset tokenisation could carry to the Australian monetary system. One such hypothetical estimate advised that financial savings of as much as AUD$13b per yr could possibly be generated for Australia’s capital markets.

Supply: https://www.rba.gov.au/speeches/2023/sp-ag-2023-10-16.html#fn1

The 2 elements driving the decreased prices have been as follows: (1) tighter bid-ask spreads reflecting the elevated buying and selling volumes of tokenised belongings; and (2) positive factors from atomic settlement (i.e. 24/7 immediate settlement) driving down different charges, together with these at the moment paid to corresponding banks concerned in cross-border funds, financial savings from decreased collateral necessities, and decreased charges from a decrease incidence of settlement fails.

The RBA’s Way forward for Cash Work Program

Mr Jones’ speech concluded by outlining the RBA’s future plans:

So the place is the Financial institution on its future of cash journey? Our overarching place is that we stay open-minded as to the useful types of digital cash and supporting infrastructure that would finest assist the Australian economic system sooner or later.

Mr Jones acknowledged that the RBA had an “lively analysis program” underway and highlighted a few of its key focus areas over the following yr:

The RBA is within the early levels of planning for a brand new undertaking assessing how completely different types of digital cash and infrastructure might assist the event of tokenised asset markets in Australia.

The RBA and Treasury will publish a joint report across the center of 2025 that may present a stocktake on CBDC analysis in Australia and set out a roadmap for future work.

The Financial institution will proceed to actively contribute to worldwide work streams, together with these aimed toward decreasing the frictions in cross-border funds.

The Financial institution will step up its engagement with a variety of exterior stakeholders on the way forward for cash. It will take quite a lot of varieties and embrace business, academia, authorities businesses, different central banks and the broader public.

It’s obvious from Mr Jones’ speech that the RBA keenly perceive the potential advantages of asset tokenisation to the monetary system and economic system, and that these potential advantages are quantifiable. The RBA is nevertheless persevering with to discover what a tokenised future may appear to be, and to that finish, it’s taking cautious steps to analysis and plan for that future, whereas mitigating the potential downsides. On this regard, the RBA is part of an ongoing global conversation amongst Authorities officers and coverage makers on the way forward for our digital economies. In fact, the way forward for cash is a query which doesn’t simply contact central bankers. It’s one that’s likely to be heavily debated by specialists and coverage makers of various stripes, and the general public at giant.

Seize and burn? UK to “destroy” illicit crypto

The UK’s Economic Crime and Corporate Transparency Act 2023 acquired Royal assent this week in response to considerations over digital monetary crimes.

The UK’s National Crime Agency (NCA) estimates that in 2021, over GBP1B in illicit money was transferred abroad in cryptoasset transactions. The UK’s new laws permits authorities to take immediate motion to seize cryptoassets where there is strong evidence of criminal activities, without needing to wait for a conviction. Additional, it introduces provisions to expedite freezing orders of cryptoassets related to crime.

Half 4 of the Act, titled ‘Cryptoassets’, amends the prevailing confiscation regime beneath the Proceeds of Crime Act 2002, incorporating new powers in respect of orders involving cryptoassets. The Authorities’s announcement states:

In distinctive circumstances, there may also be an influence to destroy seized cryptocurrency.

This energy arises as an illustration when the seized cryptoasset, upon launch, is just not claimed again inside a yr and in circumstances the place it’s opposite to the general public curiosity to grasp the cryptoassets. A cryptoasset is ‘destroyed’ whether it is:

disposed of, transferred, or in any other case handled, in such a method as to make sure, or to make it just about sure, that it’s going to not be the topic of additional transactions or be handled once more in some other method.

Curiously, the act offers that the place cryptoassets are destroyed, the accused can be taken to have paid the quantity equal to the market worth of the cryptoassets ‘in direction of satisfaction of the confiscation order’.

An accompanying impact assessment by the Home Office emphasizes the rationale for this new forfeiture energy:

[cryptoassets] can’t at the moment be recovered as simply…as a result of their distinctive technological qualities.

The Government welcomed the new legislation, stating:

Legislation enforcement businesses will profit from larger powers to grab, freeze and get well cryptoassets.

The Authorities’s announcement highlights the problem of guaranteeing that new laws is match for goal in the case of crypto-assets. The notion of “destroying” crypto-assets is one thing of a misnomer, and maybe a relic of one other period through which the proceeds of crime have been, as a rule, bodily objects that could possibly be destroyed. With the brand new laws receiving Royal Assent, it will likely be fascinating to see how the Authorities implements its new powers to “destroy” crypto-assets in follow.

The brand new laws follows stringent measures launched by the UK’s Monetary Conduct Authority (FCA) earlier this month round crypto promotions, that are supposed to guard people from deceptive or misleading practices by crypto companies. The FCA has issued over 200 warnings to crypto companies so far, which resulted in Binance temporarily suspending new user registrations in the UK whereas they evaluate compliance.

Operating drills: Making ready for a blockchain hack

Yesterday, famend blockchain safety professional, Samczsun, introduced the general public launch of the SEAL Drills initiative. SEAL Drills goals to assist blockchain protocols and initiatives put together for a possible blockchain hack by conducting a simulated assault in opposition to a protocol. The initiative is a collaboration between Sam, Isaac Patka, and plenty of different Whitehat hackers and researchers.

The objective of the initiative is practising detection, analysis and swift response throughout a blockchain assault. Having battle examined its assault simulation mannequin with Compound DAO and Yearn, the SEAL Drills staff has opened expressions of curiosity for different protocols trying to take a look at methods. Within the Yearn simulation, a group of core contributors to the protocol encountered a mock attack on an oracle price feed supposed to empty sure vaults of funds. Within the state of affairs, the staff responded by activating an emergency shutdown process to return funds to a vault.

Based on Chainalysis, practically $3.8 billion was stolen in blockchain hacks final yr, practically half of which has been linked to North Korean hackers. The SEAL Drills initiative highlights the significance of disaster administration expertise and planning in responding to blockchain hacks and cyber threats.

Correct planning can also be vitally vital in responding to the authorized implications of a cyber assault. It helps to have a disaster administration plan in place that may be activated within the occasion of an incident. Treasured time will invariably be wasted marshalling a plan after an assault happens.

Among the key issues for authorized counsel in formulating a disaster administration plan embrace:

Assembling the appropriate staff, together with subject material specialists (which can embrace, safety groups, authorized counsel, communications, government, amongst others).

Have clear strains of choice making to handle the incident.

Guarantee safe communication between the response staff.

Take steps to safe methods and information, and hint and freeze belongings (which, in a blockchain context, could contain participating blockchain analytics companies and exterior authorized counsel to hint and injunct stolen belongings).

Have a communications technique: Problem a holding assertion to handle stakeholders and public relations. It’s usually higher to say lower than extra the place not all details are recognized and hypothesis could be unhelpful. Nonetheless, well timed and clear communication is important to take care of confidence and belief.

Contemplate reporting obligations to related authorities, together with anti-money laundering, privateness or sanctions authorities.

Notifying insurers the place relevant.

Examine the incident and establish learnings.

The SEAL Drills mannequin addresses plenty of this stuff beneath excessive time constraints.

Because the previous adage goes, fail to plan, plan to fail. Given in the present day’s heightened cyber risk atmosphere, disaster administration planning is vitally vital to handle what may be an existential risk for any enterprise or start-up.

California passes crypto invoice; Governor requires session

In a transfer that echoes the latest actions in world cryptocurrency regulation (for instance see Australia and Hong Kong), Californian Governor Gavin Newsom has signed Assembly Bill 39, set to take impact in July 2025. Often known as the Digital Monetary Property Legislation, this laws marks California’s reply to New York’s “BitLicense” and will signify a constructive step in direction of regulatory readability for the blockchain business in California.

Nonetheless, the Digital Monetary Property Legislation has confronted heavy industry criticism. Regardless of this, it efficiently handed by the state’s Meeting in September 2022, establishing the groundwork for regulation and enforcement within the cryptocurrency sector.

The core options of the regulation entail empowering California’s Division of Monetary Safety and Innovation (DFPI) to craft a complete regulatory framework for blockchain dealings. This framework encompasses a licensing regime and grants the DFPI enforcement authority and rulemaking throughout the sector. Licensed crypto companies can be subjected to examinations, record-keeping, and payment disclosures to clients, guaranteeing a accountable and clear cryptocurrency panorama. The DFPI has been allotted an 18-month implementation interval to make modifications to the regime.

Governor Newsom emphasised the necessity for hanging a stability between client safety and fostering accountable innovation, stressing the collaborative nature of the method. Newsom articulated:

It’s important that we strike the suitable stability between defending customers from hurt and fostering accountable innovation, and I look ahead to working with the writer of the invoice to attain this.

The cryptocurrency group has lengthy been cautious of the “BitLicense” in New York, with CoinDesk saying it was ‘lethal to start-ups’, however might California’s method provide a glimmer of hope on the West Coast? With Congress and federal regulators taking a backseat in shaping Federal laws for digital belongings, different States have stepped in to set requirements.

The California Governor had beforehand vetoed a similar bill however is now eager to enhance upon it by business collaboration. The crypto business may have some alternatives to offer enter and form the regulatory panorama earlier than the regulation’s full implementation in 2025. California, like many jurisdictions, says it needs to strike the appropriate stability between fostering innovation and safeguarding customers, and business suggestions alongside the way in which is a key a part of that journey.

Miles Jennings, Basic Counsel of a16z, posted his reservations on an X thread concerning the potential damaging affect on players and the in any other case ambiguous definitions within the draft invoice:

Of concern is that this identical method to in-game belongings has been proposed within the Treasury session on Digital Asset change licensing.

Whereas most lawmakers, lobbyists, and federal regulators consider that new federal legal guidelines are essential, Congress remains divided on the issue. The SEC, beneath Chair Gary Gensler, has been lively in a regulation by enforcement marketing campaign, which is each costly and economically inefficient, and the necessity for complete regulation stays.

Within the absence of Congressional motion, California’s Digital Monetary Property Legislation stands as a constructive step in direction of accountable blockchain regulation and governance, demonstrating the potential for a collaborative method between business and regulators in shaping the way forward for the blockchain ecosystem, if business considerations are heard, notably round in-game and different NFT based mostly belongings.

Korea’s CBDC pilot eyes digital future

Earlier this month, the Financial institution for Worldwide Settlements (BIS) and the Financial institution of Korea (BOK) launched a report titled “A step toward new financial market infrastructure: Bank of Korea’s initiative“. In keeping with BIS’ position in “fostering accountable innovation throughout the central banking group”, the paper outlines its recommendation on Financial institution of Korea’s Central Financial institution Digital Foreign money (CBDC) pilot undertaking.

BOK established a CBDC analysis group again in 2020 dedicated to ‘constructive and accountable innovation’. In recent times, there have been quite a few experiments targeted on retail CBDC and collaborations with business banks, designed to check a CBDC’s functionalities and lifecycle operations, from ‘minting, issuance, circulation, redemption and destruction’. By connecting BOK’s take a look at CBDC system with business financial institution take a look at servers, the ‘seamless efficiency’ of earlier experiments affirmed the potential for real-world functions.

BOK’s new pilot undertaking will take this a step additional, to ascertain a CBDC community that may facilitate the issuance and circulation of digital currencies, together with tokenised deposits and tokenised e-monies. The brand new undertaking envisions a CBDC as ‘an anchor’ which allows ‘seamless exchanges’ between tokenised deposits and tokenised e-monies.

The undertaking’s key goals are:

Redirecting the general public’s curiosity in crypto belongings in direction of a extra revolutionary, constructive, and accountable channel

Supporting the mixing of tokenisation into the realm of belongings

Enhancing fee system effectivity by leveraging CBDC’s programmability

Realising the unified ledger advised by BIS for interoperability

Whereas the BOK will stay accountable for the event and implementation of the CBDC system, business banks can be granted ‘unique participation rights’ to behave as node operators and maintain CBDCs for inter-bank settlements, as collateral or reserve belongings. Business banks may also be capable of concern digital currencies (kind DC-I and DC-II, see desk beneath), nevertheless they might want to adjust to a ‘widespread technical customary’ for interoperability.

The paper recognized the next challenges and issues for retail CBDC implementation in Korea:

CBDCs could lack notable benefits in mild of Korea’s superior fee infrastructure;

Widespread adoption of retail CBDC could result in financial institution disintermediation;

Considerations over privateness infringement;

Considerations of interoperability between banks’ unbiased methods and dangers of a siloed monetary infrastructure.

BOK’s digital currencies have been designed and structured to adjust to obligations imposed on regulated entities beneath present Korean monetary providers laws to keep away from the necessity for modification of the Financial institution of Korea Act. Following the undertaking, BOK and the Monetary Providers Fee (FSC) plans to evaluate the authorized standing of the DC-I and DC-II currencies in opposition to present and future laws.

The BIS paper recognises the numerous approaches taken by jurisdictions in regulating digital belongings, noting the exclusion of deposits from the scope of Europe’s MiCA and Singapore’s distinguishing of tokenised deposits and stablecoins. In doing so, the paper means that there could also be a have to assemble a brand-new framework sooner or later, as an alternative of retrospectively becoming digital currencies into present laws.

Though the BOK believes Korea doesn’t instantly want a retail CBDC, it insists:

It’s essential to be ready for eventualities through which…CBDC turns into essential as a result of modifications within the monetary and financial panorama.

Korea’s method is smart in mild of the worldwide decline in money utilization and the continued rise of digital economies. The Federal Reserve Bank of New York, the Central Financial institution of Brazil and quite a few different countries, including Australia, are endeavor related efforts to arrange for a future through which digitally native cash is a vital function of the economic system.