Morning coinheads…

Rob “If this Hammock’s Rockin’…” Badman is having fun with a well-earned Xmas break, so that you’re caught with me once more for the subsequent few days. Bear with me as I emerge from my Christmas Turkey Coma to attempt to make heads and tails of what’s been occurring on this planet of crypto.

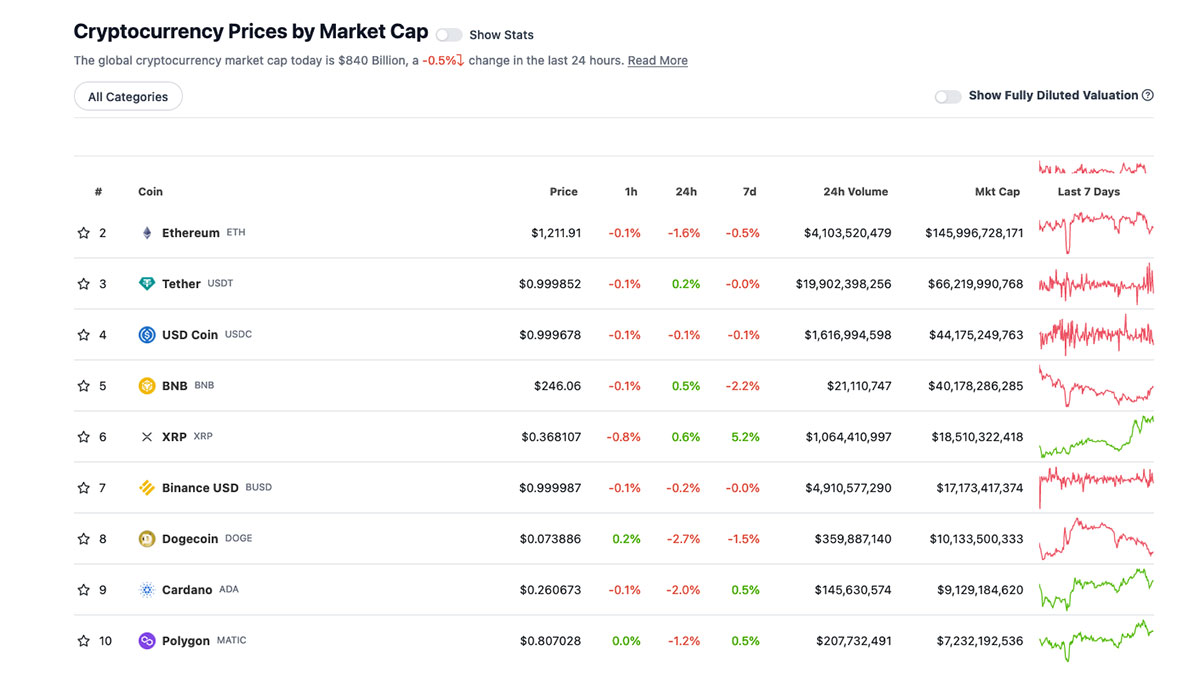

A quickfire have a look at the majors this morning, and issues are trying comparatively secure, if somewhat spongy. BTC and ETH are promoting near 1.0% down this morning, as buying and selling quantity throughout the exchanges ramps up after a mid-Christmas slowdown.

It was nearly as if a big portion of the crypto neighborhood really took a break to spend time with household… both that, or the mixed bandwidth drain of billions of recent gaming consoles being unboxed and plugged in on Christmas morning slowed your complete web to a crawl.

Let’s bounce into a number of headlines to whet your urge for food for the morning, after which I’ll have some specifics and perhaps even a fairly chart to indicate you. How thrilling!

Yo Japan. You’re performing bizarre once more…

The previous couple of weeks have been fairly bizarre in Japan’s monetary circles. The Financial institution of Japan current pivoted on its coverage to permit the yield on 10-year Japanese authorities bonds to shift as much as 0.50 per cent as an alternative of its long-preferred 0.25 per cent cap.

That made folks’s tummies rumble and despatched the yen hovering in opposition to the USD, up 4.0% in a day – which most likely doesn’t sound like all that a lot, however for an precise hold-it-in-your-hand forex, it’s outrageous.

Japanese regulators haven’t ignored the crypto house, although, saying strikes that can see Japanese exchanges embody stablecoins on the roster for the primary time, offered they:

Are instantly linked to a authorized tender (ie, the Yen or USD or no matter you may spend at a grocery store);

Are issued by licensed banks, registered cash switch brokers, and belief corporations, and;

Assure their holders the best to redeem them at face worth (as a result of it’s culturally crucial in Japan to not lose face).

Japan remains to be (we predict… it’s exhausting to inform) dispensing some fairly critical side-eye suspicion about whether or not stablecoins are going for use correctly (as shops of worth, and so on) or improperly (for laundering cash, due to course it’s going to be) – however the transfer is a step in the best course for bringing Japanese exchanges in step with most different main markets.

Octopus now nearer to Pentapus after shedding many employees

NEAR Protocol blockchain Octopus Community has gone Full Grinch this Christmas, utilizing the Happiest Time of the 12 months to unveil a cost-cutting restructure that can ship 12 of its 30 core staff off to the bread line.

The 40% headcount lower is happening alongside a 20% gutting of the surviving worker’s wages – a sturdy signal that occasions at Octopus are about as robust as a slab of BBQ tentacle that hasn’t been adequately tenderised.

(See, the gag there’s that it takes an unlimited quantity of effort to get octopus meat tender sufficient to prepare dinner properly, and normally entails a protracted and thorough beating of the cephalopod’s corpse as soon as it’s lifeless. #TheMoreYouKnow #CookingWithCrypto).

Octopus CEO Louis Liu stays optimistic and upbeat, nevertheless, saying: “the crypto winter will final a minimum of one other yr, maybe for much longer. Most Web3 startups won’t survive. I wouldn’t suggest that odd folks launch a Web3 startup within the coming yr except they obtain assist from giant institutional traders.”

Wait… that’s not even remotely upbeat. And I’m undecided what he means by “odd folks” – so perhaps solely Batman, Superman and some folks with Asperger’s will flourish in Liu’s model of the way forward for Web3.

Nonetheless, it’s clearly a super-classy act, to fireside your staff at Christmas time… but it surely neatly sums up what a correct prick of a yr 2022 has been for lots of small corporations.

… Is Argo about to go to argo-nought?

And if Louis Liu’s Pentapus of Positivity hasn’t bought you all jacked to the milkers with good feeling about how the market’s dealing with issues, there’s an announcement on the best way from NASDAQ-listed Argo Blockchain that’s hanging just like the Sword of Damacles.

Argo, to place it properly, has been in deep, deep s–t for some time now, with liquidity points mounting to the purpose that it has been restructuring tougher than a gaggle of Gold Coast bogans on The Block.

Whether or not Argo’s about to close up store, or there’s been a Christmas miracle and its managed to safe a sizeable backer to maintain it afloat, stays unclear, however the announcement is predicted pre-market, so we’ll discover out which approach the Argonauts are crusing this arvo a while.

Prime 10 overview

With the general crypto market cap at US$840 Billion, down 0.5% since this time yesterday, right here’s the present state of play amongst prime 10 tokens – in response to CoinGecko.

DAILY PUMPERS

Terra Luna Basic (LUNC), (market cap: US$1.02 billion) +7.2%

Quant (QNT), (mc: US$1.66 billion) +4.1%

OKB (OKB), (mc: US$6.03 billion) +3.6%

EthereumPoW (ETHW), (mc: US$334 million) +3.6%

Aave (AAVE), (mc: US$816 million) +2.8%

DAILY SLUMPERS

Toncoin (TON), (market cap: US$3.18 billion) -6.8%

Frax Share (FXS), (market cap: US$329 million) -4.5%

eCash (XEC), (mc: US$449 million) -4.4%

Hedera (HBAR), (mc: US$1.06 billion) -4.0%

Zcash (ZEC), (mc: US$509 million) -3.7%

(Stats correct at time of publishing, based mostly on CoinGecko.com information.)

Source link