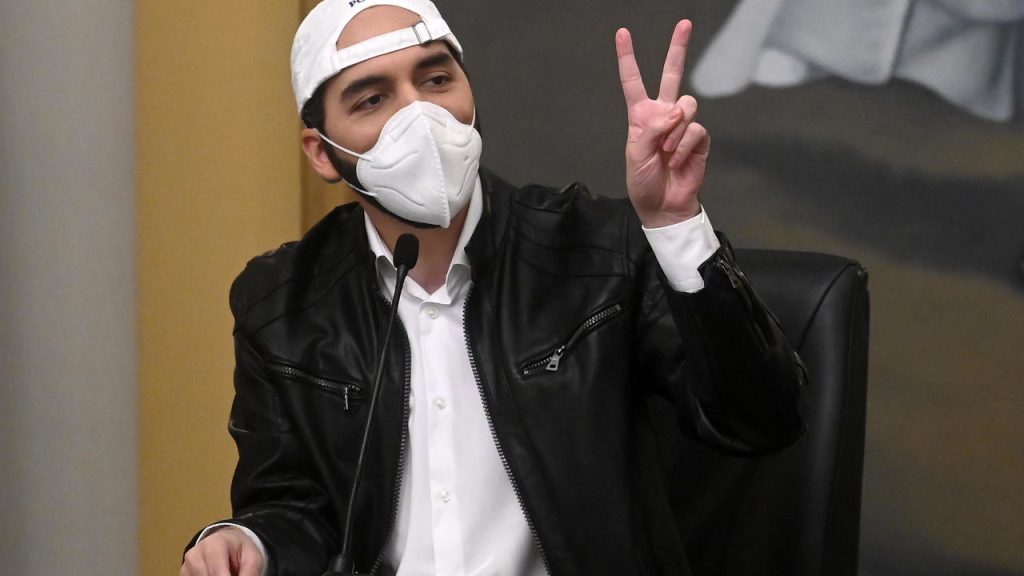

San Salvador (AFP)

El Salvador could develop into the primary nation to make bitcoin authorized tender, President Nayid Bukele introduced Saturday, saying he would quickly suggest a invoice that would remodel the remittance-dependent economic system.

The transfer would make the Central American nation the primary on the earth to formally settle for the cryptocurrency as authorized cash and would “enable the monetary inclusion of hundreds of people who find themselves exterior the authorized economic system,” Bukele stated.

“Subsequent week, I’ll ship to Congress a invoice that makes Bitcoin authorized cash,” the populist chief stated throughout a video message to the Bitcoin 2021 convention in Miami, Florida.

The invoice goals to create jobs, he stated, in a rustic the place “70 p.c of the inhabitants doesn’t have a checking account and works within the casual economic system.”

The El Salvador authorities is but to provide particulars of the invoice, which would require approval from a parliament dominated by the president’s allies.

Remittances from Salvadorans working abroad symbolize a significant chunk of the economic system — equal to roughly 22 p.c of Gross Home Product.

In 2020, remittances to the nation totaled $5.9 billion, in keeping with official experiences.

In response to Bukele, bitcoin represented “the quickest rising technique to switch” these billions of {dollars} in remittances and to stop thousands and thousands from being misplaced to intermediaries.

“Due to the usage of bitcoin, the quantity obtained by greater than one million low-income households will increase by a number of billion {dollars} yearly,” stated the president.

“This improves life and the way forward for thousands and thousands of individuals.”

The cryptocurrency market grew to greater than $2.5 trillion in mid-Might 2020, in keeping with the Coinmarketcap web page, pushed by curiosity from more and more severe traders from Wall Road to Silicon Valley.

However the volatility of bitcoin — presently priced at $36,127 — and its murky authorized standing has raised questions on whether or not it might ever change fiat forex in day-to-day transactions.

© 2021 AFP