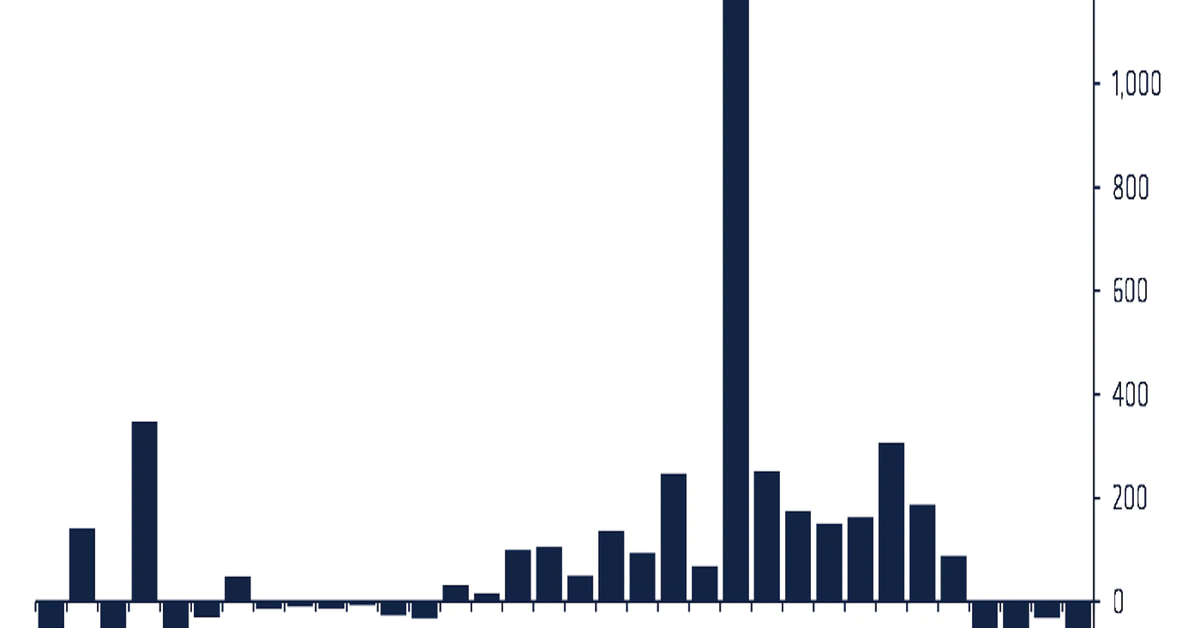

As crypto prices fall, fund investors remain bearish with record weekly outflows from digital asset investment products totaling $207 million in the seven days through Jan. 7.

The spate of redemptions adds to the pressure on the market that began in mid-December, bringing the four-week outflow total to $465 million.

Investment funds focused on bitcoin, the world’s largest cryptocurrency by market cap, saw outflows of $107 million during the seven-day period, according to a report published Monday by CoinShares.

Bitcoin’s outflows were a “direct response” to the minutes of the Federal Reserve’s December meeting published last week that revealed concerns over rising inflation – and the resulting fear among investors that the central bank might move quickly to tighten monetary conditions.

Many investors and analysts say bitcoin has benefited from the ultra-loose monetary policies in place since the coronavirus hit in March 2020.

CoinShares noted that over the last four weeks, crypto investment products have represented up to 25% of total bitcoin trading turnover, highlighting greater investor activity than usual.

Ethereum-focused funds saw outflows of $39 million last week, bringing the last four-week run of outflows to $180 million.

Multi-asset crypto investment fund outflows totaled $37 million, suggesting investors were much less discerning in selling positions; although funds focused on Solana and XRP saw minor inflows, according to the report.