Cryptocurrencies together with Bitcoin and Ethereum can witness large selloffs subsequent week because the US debt default deadline nears, Blockchain.com CEO stated on Thursday. Shares and crypto costs can even fall after a debt ceiling deal because the US Treasury Division expects to issue $700 billion in Treasury bills to make up misplaced funds this quarter.

US Debt Scenario To Convey Crypto Market Correction

In the course of the Qatar Financial Discussion board organized by Bloomberg, Blockchain.com CEO Peter Smith stated US default or recession can even affect crypto initially. Nonetheless, crypto costs will recuperate after a brief interval.

“On a protracted horizon, these are most likely good for crypto…If the U.S. authorities defaults, we’ll most likely see a fast pull-back after which a really robust push upward within the crypto market.”

Smith additionally agreed that the crypto market recovering slowly this 12 months and 2025 shall be an enormous 12 months for crypto Bitcoin halving will occur in April.

“I believe the crypto market goes to be a lot larger sooner or later than it’s at present,” @blockchain‘s @OneMorePeter #QatarEconomicForum #منتدى_قطر_الاقتصادي @jennzaba pic.twitter.com/WneSNQr6iV

— Bloomberg Dwell (@BloombergLive) May 25, 2023

Blockchain.com can also be contemplating an enlargement of its small Center Jap workplace in Dubai, the United Arab Emirates. Dubai regulators and digital asset rules are progressive in crypto adoption. Blockchain.com gained approval from Digital Property Regulatory Authority (VARA) in September.

If the debt ceiling deal between President Joe Biden and Republicans failed, will probably be “catastrophic” for the worldwide market. Nonetheless, if the deal is reached, it should pull liquidity out of economic markets.

Furthermore, the US Federal Reserve to pivot this 12 months. Fed officers are calling for two more hikes as inflation stays increased and the roles market remains to be tight.

Additionally Learn: Bitcoin, Crypto Slides As Fitch Puts US Rating Watch Negative On Debt Ceiling Standoff

Bitcoin Worth Loses Momentum

BTC price briefly fell beneath the $26k degree at present as Bitcoin buyers panic as a result of political partisanship in debt ceiling talks. Bitcoin fell 2% prior to now 24 hours, with the worth at present buying and selling at $26,400. In the meantime, the second largest crypto ETH price trades above $1800, after falling to an intraday low of $1763.

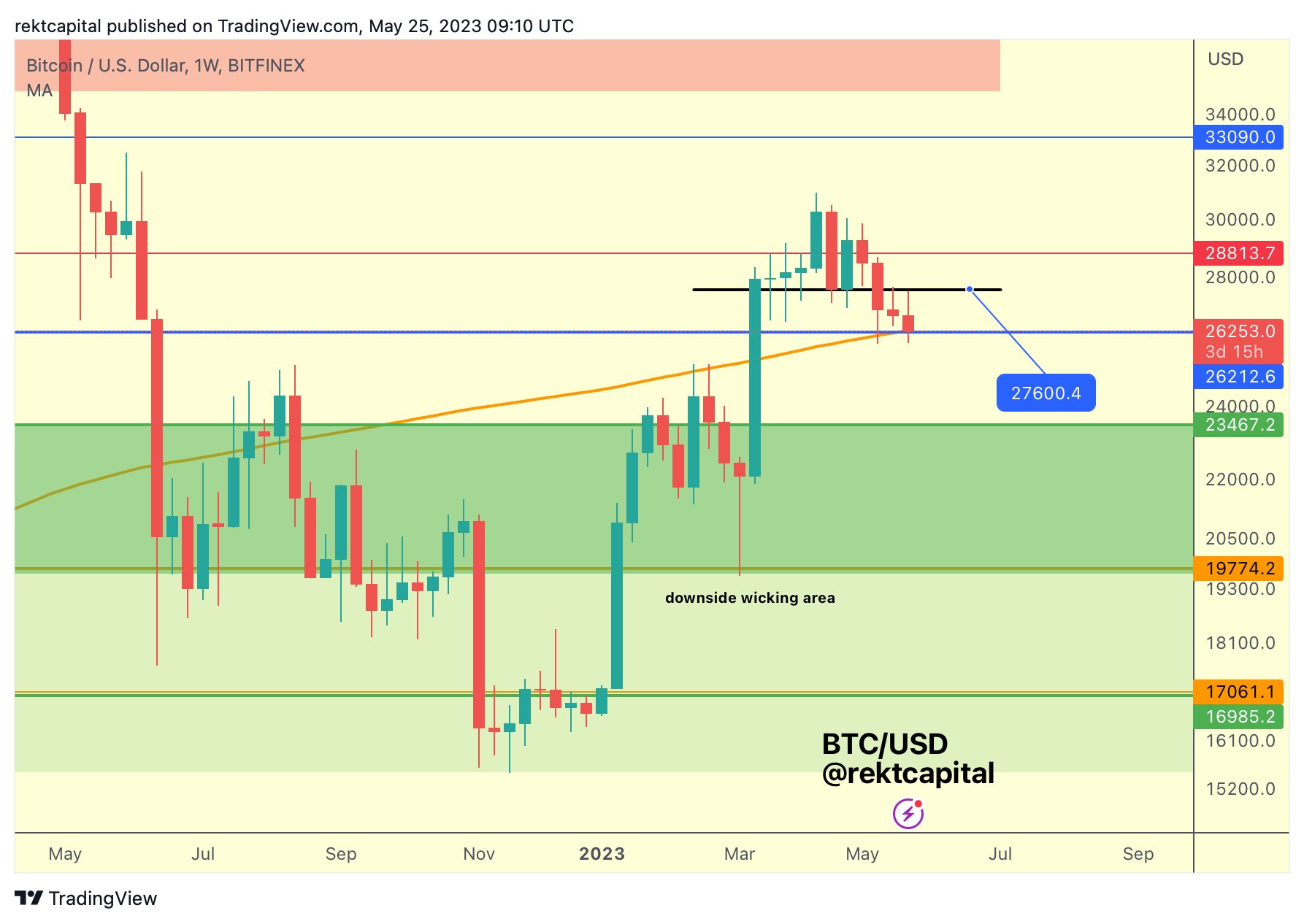

In style analyst Rekt Capital predicts that if Bitcoin loses the $26,200 assist then the worth would drop into the decrease $20,000. The $26200 occurs to be confluent assist with the 200-week MA.

Additionally Learn: Binance Suspends Crypto Deposits As Multichain CEO Remains Missing

The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.