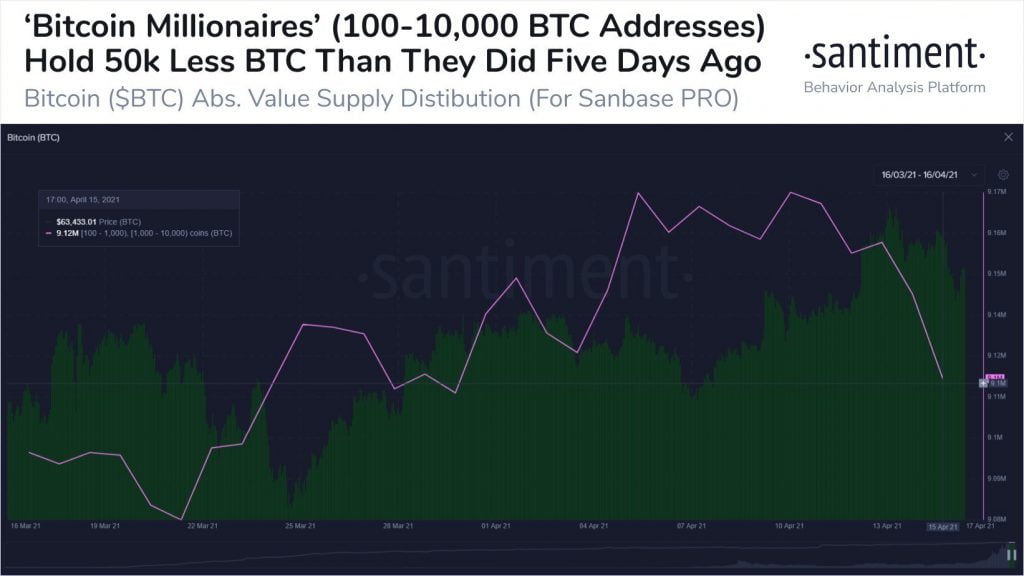

Bitcoin whales holding 100 to 10,000 BTC have collectively sold 50,000 BTC in the last five days. This amount of Bitcoin translates to roughly $3 Billion, using a value of $61k. The selling by whales was captured by the team at Santiment through the following statement and accompanying chart demonstrating the 50k BTC reduction in their collective holdings.

Bitcoin‘s ‘Millionaire Addresses’ (holding ~$6.1M to $610M in value currently) have shed about 50,000 BTC collectively in the past five days. Cryptocurrency‘s #1 asset has seen increased volatility, but has remained above $60k since April 10th.

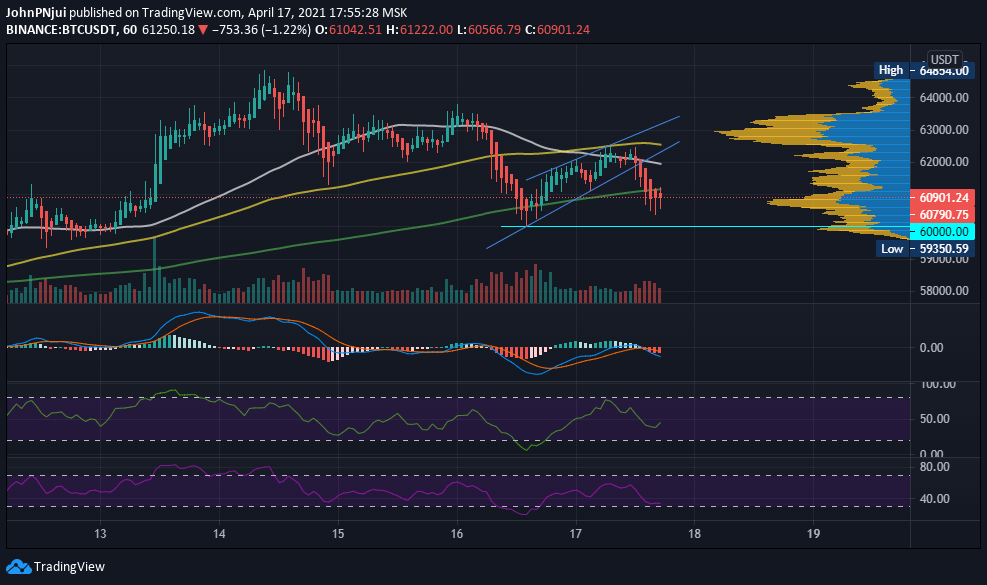

Bitcoin’s Ascending Triangle Broke Down, $60k is Now Support

Yesterday, the King of Crypto dipped to a local low of $60k after news broke of the Turkish Central Bank banning all cryptocurrencies being used as a form of payment. However, Bitcoin soon bounced back to post a local high of $62,500 earlier today. In the process of recovering from the selloff, Bitcoin formed a rising wedge pattern that broke down as can be seen in the chart below.

From the chart, it can be observed that Bitcoin is once again in bearish territory with the $60k price area acting as macro support as the weekly close inches closer.

Furthermore, the 50 (white) and 200 (green) moving averages in the hourly chart above, seem destined to print a death cross in the hours to follow. The red trade volume also confirms the selling environment with the one-hour MFI and RSI reinforcing the same.

If Bitcoin can once again bounce off the $60k price level, it would print a double bottom that could propel it to new heights, setting new all-time highs.

However, if the bearish momentum is sustained between now and the new week, Bitcoin could be facing a continuation of the bearish scenario with the following areas offering additional short-term support.

$59,300$58,800$58,000$57,300$56,500$56,000