Bitcoin (BTC) has been in a ranging market ever since the leading cryptocurrency experienced a significant pullback, which prompted a $10K daily loss from the $52,000 level.

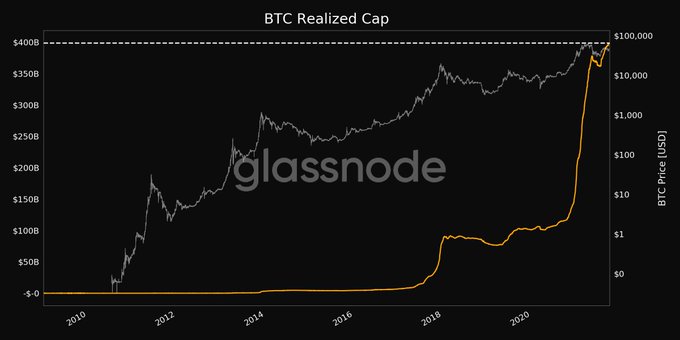

Nevertheless, the realized capitalization has been on an upward trajectory after hitting a record high. On-chain metrics provider Glassnode explained:

“Bitcoin realized cap just reached an ATH of $398,671,308,690.99.”

Realized market capitalization is a metric calculated by valuing each supply unit at the exact price it last moved on-chain or at the last time it was transacted.

As a result, it does not calculate coins that remain unmoved because cryptocurrencies can be lost, unreachable, or unclaimed. This contrasts with the standard market capitalization that values every supply unit evenly at the current market price.

BTC fear & greed index moves to the neutral level

According to market analyst Lark Davis, the Bitcoin fear and greed index jumped to a neutral level of 54 from a fear zone of 20.

Davis had previously noted that FUD (fear, uncertainty & doubt) had engulfed the BTC market, lowering the fear and greed index. He, however, acknowledged that these were opportunity times, given that some investors had adopted the strategy of buying the dip.

Meanwhile, Raoul Paul, the founder and CEO of Real Vision, believes that Bitcoin could witness an upside move based on the consolidation witnessed on the long-term log chart. He stated:

“The Bitcoin long-term log chart looks pretty luscious. Who knows if the wedge breaks on the first attempt, but a consolidation pattern of this magnitude usually leads to a very, very powerful upside move.”

Macro behavioural trends being witnessed in the Bitcoin market

On-chain analyst Will Clemente believes the different approaches adopted by short-term BTC holders and their long-term counterparts are boiling down to a game between speculators and investors. He acknowledged:

“The dynamics between the short-term holder and long-term holder supply illustrate the underlying macro behavioral trends between speculators and investors. – LTHs buy weakness, sell into strength to speculators. – STHs buy strength, sell into weakness, or age into LTHs.”

On the other hand, market insight provider Dilution-proof stipulated that Bitcoin’s on-chain trends looked favourable despite the leading cryptocurrency closing with a 7% loss in September.

Bitcoin’s circulation recently hit a 2-month high, which suggested price could follow suit.

Image source: Shutterstock