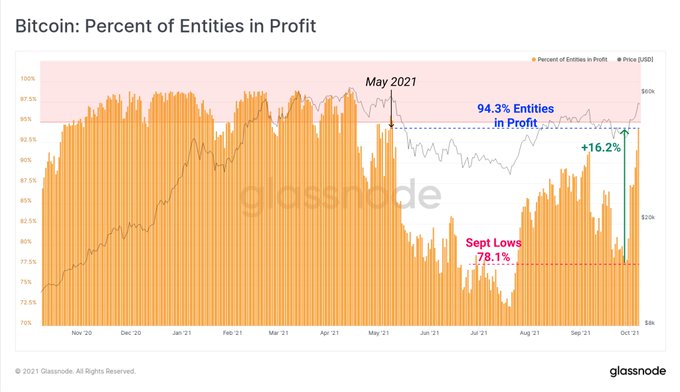

As Bitcoin (BTC) briefly touched the $55K level, a fate is last seen in May, profitability in this market scaled to new heights.

On-chain insight provider Glassnode said:

“Bitcoin entities in profit have risen to 94.3%. Over 16.2% of all on-chain entities have returned to profit since the Sept lows. The last time this many network entities were in profit was before the sell-off in May.”

After setting an all-time high (ATH) price of $64.8K in mid-April, Bitcoin suffered from a sharp correction on May 19 as the price fell to around $30,000, resulting in the biggest single-day drop of the price up to 30%. Furthermore, this price drop indicated the first time that BTC had dropped below the 200-day moving average (MA).

The 200-day MA is a key technical indicator used to determine the general market trend. It is a line that shows the average closing price for the last 200 days or roughly 40 weeks of trading.

Nevertheless, Bitcoin has regained momentum because it was able to breach the psychological price of $50,000 recently. The top cryptocurrency was up by 21.79% in the last seven days to hit $54,479 during intraday trading, according to CoinMarketCap.

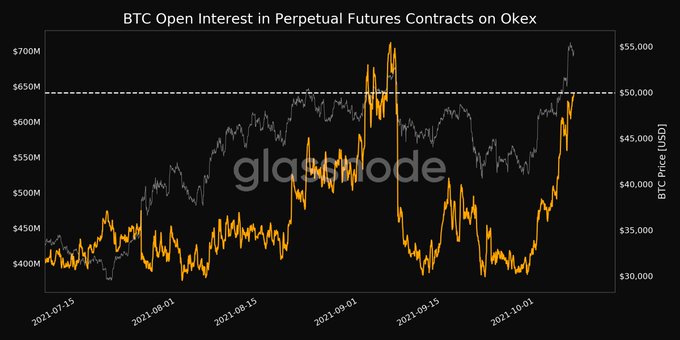

Bitcoin open interest surges

According to data analytic firm IntoTheBlock:

“Futures markets are heating up once again. Positive funding rates in Bitcoin perpetual swaps across several exchanges, and going as high as 0.11% in FTX. As well, the open interest is above $14 billion.”

Glassnode also noted that Bitcoin open interest in perpetual futures contracts had reached a monthly high on crypto exchange Okex.

Open interest usually increases with a price surge, thus showing the two are strongly correlated.

Meanwhile, more participants continue joining the BTC bandwagon because the number of new addresses in this network recently reached a 4-month high of 17,818.619.

On the other hand, Bitcoin’s dominance in the crypto space has been on an upward trajectory, which enabled the market capitalization to top the $1 trillion mark, a milestone first seen in February.

Image source: Shutterstock