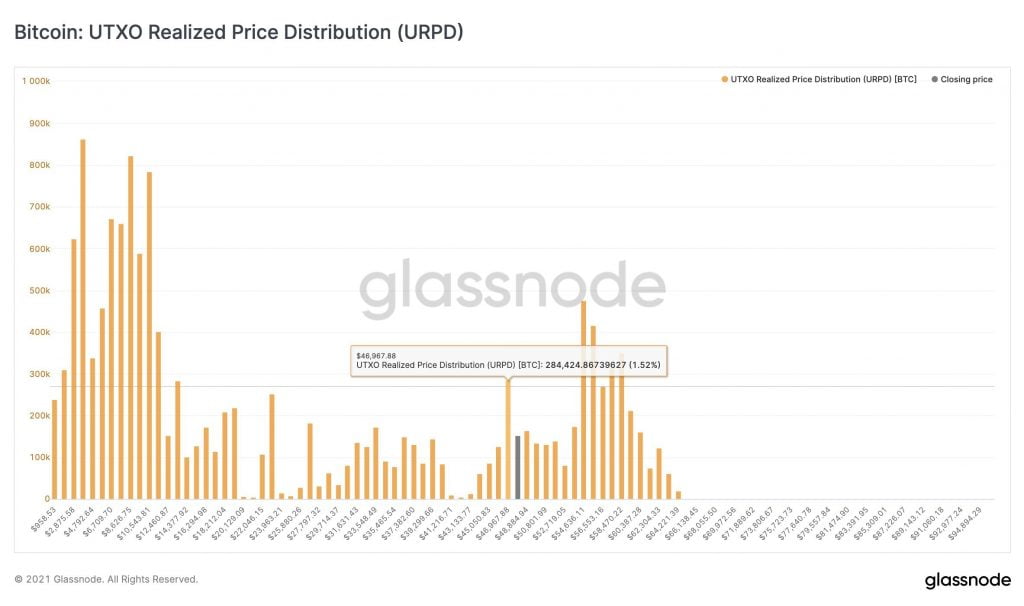

Bitcoin has strong on-chain support at $47k. This support zone was identified by the Co-founder and CTO of Glassnode, Rafael Schultze-Kraft, who shared his observation through the following statement and accompanying chart.

…ideally we hold the strong support at $47,000. It starts becoming pretty much on-chain wasteland for a while below $45k.

Bitcoin losing $50k Will Open the Doors to $43k – $44k

Bitcoin losing $50k Will Open the Doors to $43k – $44k

As mentioned by the Co-founder and CTO of Glassnode, Bitcoin’s $47k support is strong but a breakdown of this defense will open the doors to a potential wasteland below $45k.

This theory was also explored by the team at Crypterium analytics who pointed out that Bitcoin failing to hold $50k will lead to a potential breakdown to lower levels as explained below.

Bitcoin fell from $55,500 to $48,500 in a day. However, buyers quickly bought back the fall and returned the price above $50,000. This is a pretty strong drop considering that literally last week we saw $10 billion in liquidations. At the $50,000 mark, it can be seen that buyers practically do not hold positions.

Indicators do not add optimism…All of these signs indicate that Bitcoin’s decline will continue, with the next major resistance in the $43,000 — $44,000 range. If the Bitcoin price fixes below $50,000 on the 4-hour timeframe, it will be a clear signal to sell Bitcoin.

Kimchi Premium Collapses from 26% to 0%

Also worth mentioning is that the South Korean premium on Bitcoin, also known as Kimchi Premium, dropped from 26% to 0% in the recent Bitcoin meltdown. The team at CryptoQuant captured the decline through the tweet below.

Korea Premium Index became zero from 26%.

Chart 👉 https://t.co/L15XuxqABJ pic.twitter.com/UHZRZNsFXz

— CryptoQuant.com (@cryptoquant_com) April 23, 2021

The Kimchi premium is used by BTC traders to gauge the mood in the crypto markets with a high positive value indicating bullishness. Therefore, a zero value indicates a neutral or potentially bearish Bitcoin market environment moving forward.

Bitcoin losing $50k Will Open the Doors to $43k – $44k

Bitcoin losing $50k Will Open the Doors to $43k – $44k