Once I first heard that El Salvador had handed its Bitcoin Regulation, within the early morning hours of June 9, I used to be astonished: it by no means occurred to me that any nationwide authorities would embrace Bitcoin, making it an official medium of change. As a longtime advocate of what F.A. Hayek, the Nobel Prize profitable economist, known as “selection in foreign money,” I welcomed any nation’s try and let Bitcoin compete on a stage taking part in discipline with its present, official cash.

However once I turned to the two-page lengthy statute itself, my pleasure turned to dismay. Although elements of it do certainly put Bitcoin on an equal footing with the U.S. greenback, El Salvador’s official foreign money since 2001, the legislation’s seventh article says that “Each financial agent should settle for bitcoin as fee when provided to him by whoever acquires an excellent or service.” In different phrases, Bitcoin is to be, not only a authorized tender in El Salvador, however a obligatory one.

George Selgin is the director of the Cato Institute’s Middle for Financial and Monetary Alternate options.

Obligatory selection?

Forcing companies to simply accept some specific cash is each uncommon and totally at odds with the Hayekian philosophy that led to Bitcoin’s growth and brought about so many libertarians to embrace it. “Why,” Hayek requested,

ought to we not let individuals use freely what cash they wish to use?…I’ve no objection to governments issuing cash, however I consider their declare to a monopoly, or their energy to restrict the varieties of cash wherein contracts could also be concluded inside their territory…to be wholly dangerous.

Alas, “to restrict the varieties of cash wherein contracts could also be concluded inside their territory” is simply what El Salvador’s Bitcoin Regulation proposes.

Confusion about “authorized tender”

Regardless of what many individuals assume, deeming some varieties of cash “authorized tender” sometimes means nothing greater than that, as far as the courts are involved, a debtor can use, say, U. S. authorized tender to repay an excellent U.S. greenback debt, even when a creditor would moderately have the debt paid another method. Though he wasn’t eager on such legal guidelines, Hayek understood that they have been each frequent and, with notable exceptions, not particularly burdensome.

Obligatory or “pressured” tender legal guidelines, like article 7, obliging everybody to simply accept sure varieties of cash for any fee in anyway, are one other kettle of fish. Traditionally, such legal guidelines have nearly at all times been resorted to by oppressive, revenue-hungry governments, which generally went to make their violation a capital crime. Based on Dror Goldberg, an knowledgeable on the historical past of authorized tender legal guidelines, pressured tender laws:

strikes on the very coronary heart of the liberty of change and contract. As its sensible implication has sometimes been to pressure producers to half with all their produce for paper, it will also be a extreme violation of property rights. It’s a rule that penalizes passive behaviour. It’s, or needs to be, a controversial rule, not like a rule prohibiting counterfeiting of cash.

Most international locations in the present day don’t have pressured tender legal guidelines. It’s completely authorized, for instance, for a U.S. service provider to refuse authorized tender. Each “credit score solely” enterprise does so (just some cash and Federal Reserve notes are authorized tender). A enterprise may even insist on fee in bitcoin. In El Salvador likewise, it’s already authorized for a enterprise to simply accept bitcoin solely: although it’s (and can stay) authorized tender for paying greenback money owed, the U.S. greenback has by no means been a pressured tender. Article 7 is sui generis.

Victimless coercion?

Article 7’s apologists insist that it actually doesn’t contain any coercion. They be aware, to start with, that the Bitcoin Regulation’s Article 12 exempts “those that, by evident and infamous reality, do not need entry to the applied sciences that enable them to hold out transactions in bitcoin” from it. However most Salvadorans have smartphones, and the one different “applied sciences” wanted are web entry and an app or two, which the federal government plans to provide to these presently missing them.

The federal government additionally plans to make it doable for anybody paid in bitcoin to have them immediately transformed into digital U.S. {dollars}, and to bear any change danger concerned, utilizing a $150 million “belief fund” to be administered by government-run change or “Casa de Cambio” arrange at BANCASEL, El Salvador’s government-owned growth. In impact, the Casa de Cambio will function one large stockjobber, taking the other facet of Salvadoran’s bitcoin bets – a dangerous enterprise, since a bullish bitcoin market may even see comparatively few bitcoin conversions, whereas a bearish one, like this week’s, may see many extra. And although it should nominally be borne by the federal government, that danger will actually be born by Salvadoran taxpayers, who should foot the invoice each for the preliminary fund and for any losses it incurs.

Bitcoin’s restricted attraction

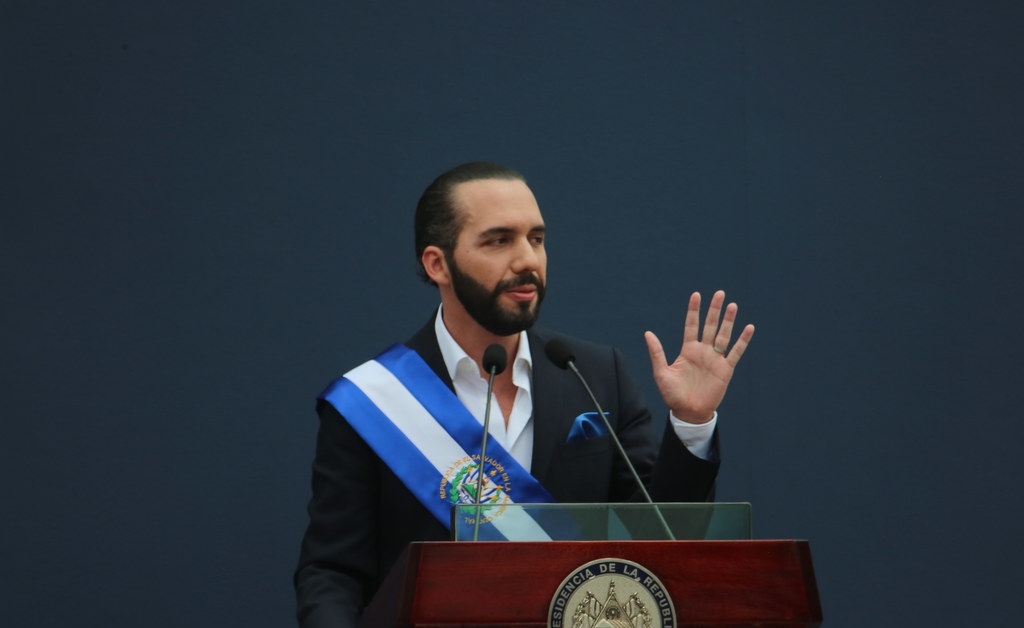

As a substitute of insisting that Salvadorans shouldn’t thoughts Article 7, the Bitcoin Regulation’s defenders needs to be asking whether or not they do thoughts it. The response to the legislation to date leaves little doubt. Complaints have already pressured Bukele to again away from his plan to have the federal government pay its personal staff in Bitcoin.

The response to a current survey taken by El Salvador’s Chamber of Commerce exhibits, moreover, that over 92% of all these surveyed, and 94% of collaborating entrepreneurs, would moderately nor have to simply accept it. Most additionally stated that they’d moderately not take remittances in it, and that they deliberate to transform no matter bitcoin they acquired into {dollars}. Inspired by such sentiments, a deputy of El Salvador’s main opposition social gathering has already filed a go well with difficult the Bitcoin Regulation’s constitutionality.

However maybe the very best proof of bitcoins’ restricted attraction is none apart from Article 7 itself. In spite of everything, have been bitcoin actually the “excellent” change medium Bukele claimed it to be in a current interview, and Salvadorans may solely achieve by switching to it, Article 7 merely wouldn’t be needed. Making bitcoin acceptance costless, supplying the mandatory infrastructure, expertise and coaching and easily permitting Salvadorans to make use of it, with out penalizing them, by means of capital good points taxes or in any other case, for doing so, must suffice to finally Bitcoinize El Salvador.

As long as it stays on the books, Article 7 ought to remind us, and the individuals of El Salvador, that President Bukele isn’t fairly satisfied by his personal rhetoric.