Cryptocurrency addresses allegedly used by Russian exchange Suex, recently placed under U.S. sanctions, have received more than $934 million in crypto assets, blockchain analysis suggests. According to the Treasury Department, over 40% of the platform’s transactions involved criminal actors. A Suex co-founder has denied any illegal activity.

Sanctioned Crypto Broker Suex Processed $370 Million of Illicit Crypto Funds, Report

Taking steps to counter ransomware attacks, the U.S. Department of the Treasury set its sights on digital asset exchanges this week. As part of the measures, the Department’s Office of Foreign Assets Control (OFAC) imposed sanctions on Suex, a Russia-based over-the-counter crypto broker, which has been accused of facilitating ransomware payments and money laundering.

On Tuesday, OFAC issued an updated advisory on the risks associated with ransomware and added Suex OTC s.r.o. to its Specially Designated Nationals and Blocked Persons (SDN) List. The office also published a number of BTC, ETH and USDT addresses controlled by the entity, which is incorporated in the Czech Republic but operates out of physical offices in major Russian cities Moscow and Saint Petersburg.

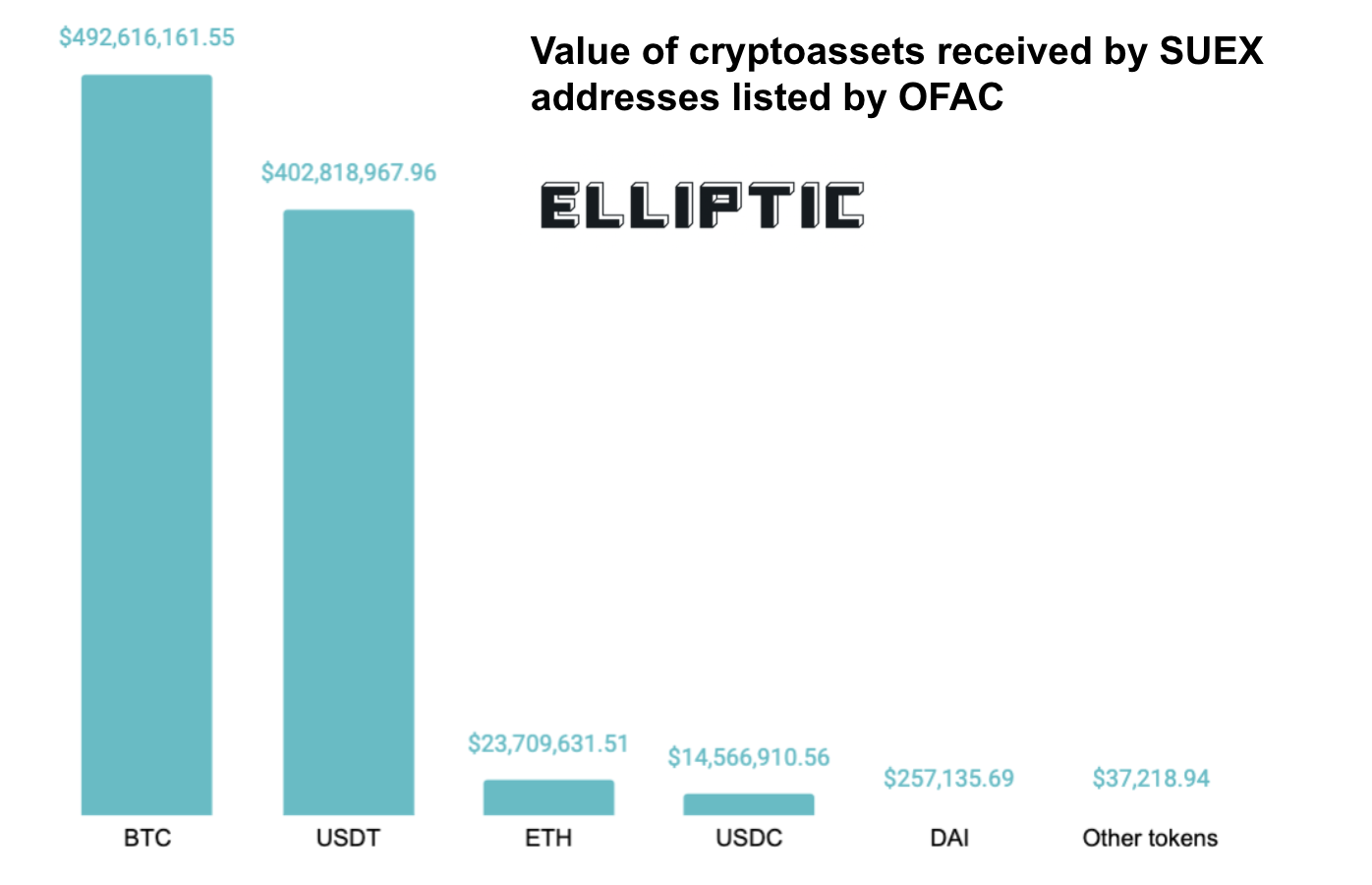

According to a report by Elliptic, the 25 blacklisted addresses have received over $934 million worth of crypto assets. Based on OFAC’s claim that 40% of the trading on Suex involved illicit funds, the blockchain analytics company estimates that the total of crypto transactions linked to illegal activities amounts to over $370 million in fiat equivalent.

Elliptic notes that with the action against the Russian exchange, the number of cases in which OFAC has imposed sanctions on activities involving cryptocurrencies has reached seven. Furthermore, the office’s list of crypto addresses linked to threat actors has exceeded 120 entries.

Following the decision of the U.S. financial intelligence and enforcement agency, American companies and private individuals should not engage in crypto transactions with the sanctioned Russian broker. Restrictions apply to U.S. banks as well, which must avoid processing fiat currency transactions on behalf of Suex and clearing transfers for banks working with the exchange, Elliptic added, emphasizing:

The impact could be a chilling one — effectively cutting off Suex from any downstream access to the U.S. dollar clearing system.

Suex Co-Founder Rejects Allegations of Illegal Activities

There has been no official reaction to the sanctions from Suex yet, but a Russian entrepreneur and executive, Vasily Zhabykin, has confirmed in a phone conversation with the New York Times that he is one of its founders. Suex, he explained, was established to develop software for the financial industry. Zhabykin denied any illegal activity and suggested his company might have been targeted by mistake. The Treasury Department has provided few details about the entity, except for two addresses in Moscow and Prague, respectively, and the exchange’s website, Suex.io.

Besides Vasily Zhabykin, reportedly involved in the company are Egor Petukhovsky, Ildar Zakirov, Maxim Subbotin, Maxim Kurbangaleev, and the Czech venture capitalist Tibor Bokor, Forklog reported. Speaking to the crypto news outlet, Kurbangaleev denied direct involvement, admitting only that he and his business partners considered a partnership with the Czech-registered entity back in 2019. Petukhovsky, a Russian national, has been identified as the biggest shareholder in Suex OTC s.r.o., while Zhabykin and Bokor are believed to be its executives.

An investigation by the blockchain Intelligence firm TRM Labs reveals that “Suex initially operated under the corporate ownership of an Estonian company – Izibits OU, which still holds an Estonian virtual asset service provider license on its behalf.” Izibits, which is listed as Suex’s corporate owner on its Russian-language website, is also the operator of Chatex, a Telegram bot offering crypto exchange services. The Suex.io domain is registered by the St. Vincent-based Hightrade Finance Ltd. which is the legal entity Chatex users are required to contract under in its Terms of Service agreement.

What are your thoughts on the Suex case and the U.S. sanctions imposed on the Russian crypto broker? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.