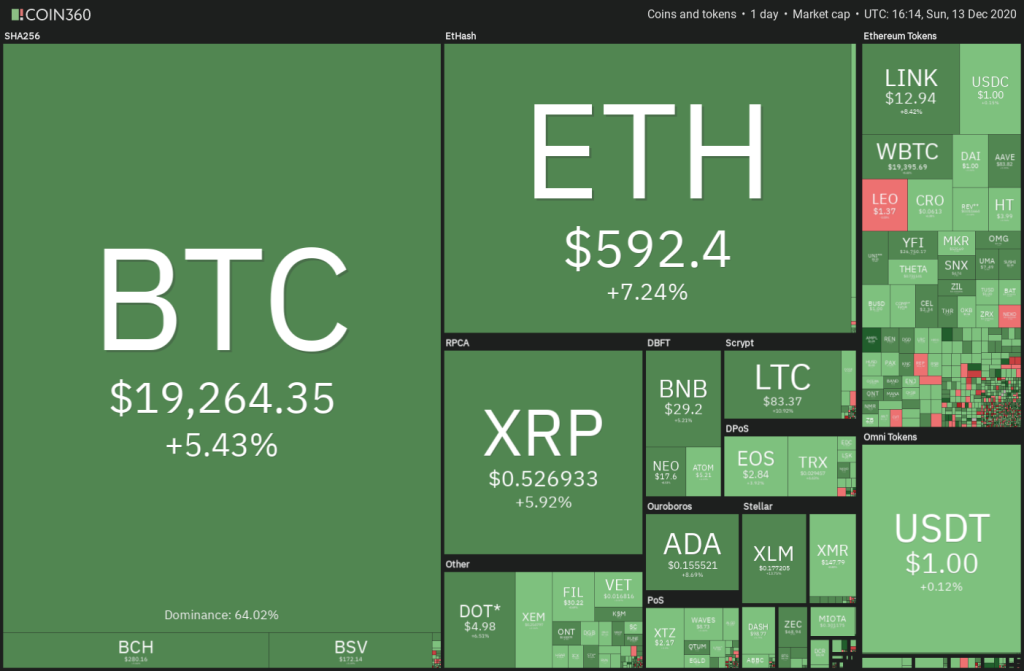

December is proving to be another blockbuster month for Bitcoin as the flow of institutional investors injecting funds into Bitcoin continues to increase.

Business intelligence firm MicroStrategy announced that it had raised $650 million worth of convertible bonds at a rate of 0.75% due in 2025. The company now plans to invest the net proceeds in Bitcoin after identifying its “working capital needs and other general corporate purposes.”

When institutional investors show such a large appetite to buy Bitcoin (BTC) near the all-time high, it is no surprise that the corrections have been shallow.

Tyler Winklevoss said in a recent interview with CNBC that institutional investors are worried about the “oncoming inflation and the scourge of inflation with all the money printing and the stimulus from the COVID pandemic lockdowns.” Hence, they have been putting money into Bitcoin.

Today, Bitcoin price surged back above the $19,000 level and it may challenge the psychological $20,000 resistance. If this level is broken out with conviction, it may create FOMO among retail traders as many have not participated in the current rally.

If money from retail investors also starts gushing in, then Bitcoin could pick up momentum and start the next leg of the up-move.

Along with Bitcoin, there are a few altcoins that may participate in the up-move next week. Let’s study the charts of the top-5 cryptocurrencies in order to spot the critical support and resistance levels to watch out for.

BTC/USD

Bitcoin closed below the 20-day exponential moving average ($18,435) on Dec. 10 and 11. However, the long tail on the Dec. 11 candlestick shows that the bulls purchased the dip instead of panicking and dumping their positions.

The price rose above the 20-day EMA on Dec. 12 and this could have trapped some aggressive bears who went short in the past few days expecting a sharp fall. This short covering and buying by the bulls pushed the price above the descending channel today.

The price has again reached the $19,500 to $20,000 overhead resistance zone. If the bulls can thrust the price above this zone, the next leg of the uptrend could begin.

Conversely, if the price again turns down sharply from the current levels and plummets below $17,500, it could signal that a short-term top is in place. Such a move could pull the price down to the next support at $16,191.02.

The 20-day EMA has started to turn up and the relative strength index (RSI) has rebounded off the 50 level, which suggests that bulls have the upper hand.

The 4-hour chart shows an ascending triangle formation, which will complete on a breakout and close above the overhead resistance zone. This setup has a target objective of $23,576.

However, the bears are currently attempting to stall the up-move at the $19,500 resistance. If the price turns down from the current levels, the bulls are likely to buy on any dip to the 20-EMA. A strong rebound off this support will improve the prospects of a breakout above $19,500.

This bullish view will be invalidated if the BTC/USD pair turns down from the current levels and breaks below the trend line of the triangle.

A breakdown of a bullish setup traps several aggressive bulls and that could result in panic selling. If that happens, a drop to $16,191.02 may be on the cards.

ETH/USD

Ether (ETH) has broken out of the descending channel, which suggests advantage to the bulls. The price can now move up to the $622.807 to $635.456 overhead resistance zone.

The RSI has bounced off the midpoint and broken out of the downtrend line, which suggests that bulls have the upper hand.

If the bulls can push the price above the resistance zone, the next leg of the uptrend could begin. Although there could be some pit stops in between, the next target is $800.

On the other hand, if the ETH/USD pair turns down from the overhead resistance but does not give much ground, it will be a positive sign and will increase the likelihood of a breakout of the resistance zone.

This bullish view will be invalidated if the price turns down from the current levels and re-enters the channel. Such a move will suggest that the current breakout was a bull trap.

The 4-hour chart shows an ascending triangle formation, which will complete on a breakout and close above $622.807. The moving averages on the verge of a bullish crossover and the RSI is in the positive territory indicate that bulls have the upper hand.

This positive view will be invalidated if the price turns down from the current levels or the overhead resistance and breaks below the triangle. Such a move could result in a drop to $488.134.

XMR/USD

Monero (XMR) completed an inverse head and shoulders pattern on Dec. 7 but the bears quickly dragged the price back below the neckline on Dec. 9. However, the bulls again purchased the dip to the 20-day EMA ($133) and propelled the price back above $135.50 on Dec. 11. This suggests aggressive buying at lower levels.

The upsloping moving averages and the RSI above 66 suggest advantage to the bulls. The target objective of the breakout from the bullish setup is $167.

However, the bears may have other plans. They are likely to defend the psychological level at $150. If the price turns down from this resistance but rebounds off the $135.50 support, it will suggest that bulls are accumulating at lower levels.

On the contrary, if the price drops below the $135.50 support and the 50-day SMA ($124), it will suggest that the bears are back in the driver’s seat.

The 4-hour chart shows the formation of an ascending triangle pattern that completed on a breakout and close above $142.50. However, the XMR/USD pair has not picked up momentum and the price is stuck inside the $142.50 to $150 range.

If the bulls can thrust the price above $150, the uptrend could resume with the next target at $162.50. The upsloping moving averages and the RSI in the positive zone suggest that the path of least resistance is to the upside.

XEM/USD

NEM (XEM) soared on Dec. 12 and the price reached the $0.27688 overhead resistance today. The bears are currently attempting to stall the up-move at this resistance.

However, if the bulls do not give up much ground from the current levels, it will suggest that traders are not booking profits in a hurry. That could keep the price range-bound near the overhead resistance.

The upsloping 20-day EMA ($0.209) and the RSI near the overhead resistance suggest that the path of least resistance is to the upside. If the bulls can propel the price above $0.27688, the XEM/USD pair could move up to $0.3564607.

The bears are aggressively defending the overhead resistance. If the price rebounds off the 20-EMA, it will enhance the prospects of a breakout of $0.27688. The upsloping 20-EMA and the RSI in the positive zone suggest bulls have the upper hand.

Contrary to this assumption, if the price breaks below the moving averages, a drop to the trendline is possible. A break below this support will suggest that the bulls have lost their grip.

AAVE/USD

AAVE is trading inside an ascending channel. The price turned down from the $95 overhead resistance on Dec. 8, but the positive sign is that the bulls have purchased the dip to the 20-day EMA ($77).

The RSI has once again bounced off the midpoint and the 20-day EMA has started to turn up. This suggests that the correction may be over and the bulls are back in control. The first target on the upside is a retest of the $95.

If the bulls can push the price above $95, the next leg of the up-move could begin. The $100 psychological level may act as a resistance but if the bulls can drive the price through it, the AAVE/USD pair could rise to the resistance line of the channel at $112.

This bullish view will be invalidated if the price turns down from the current levels and plummets below the support line of the channel. Such a move will suggest that the trend has turned in favor of the bears.

The price turned up from $70.564, just above the support line of the ascending channel but the bears are attempting to stall the relief rally at $86.14.

If the bulls can push the price above this resistance, the pair could rise to $95. A break above $95 could start the next leg of the uptrend.

On the other hand, if the price turns down from $86.14, the pair may form the right shoulder of a possible inverse head and shoulders pattern. This view will be negated if the price dips below the $70.50 support.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.